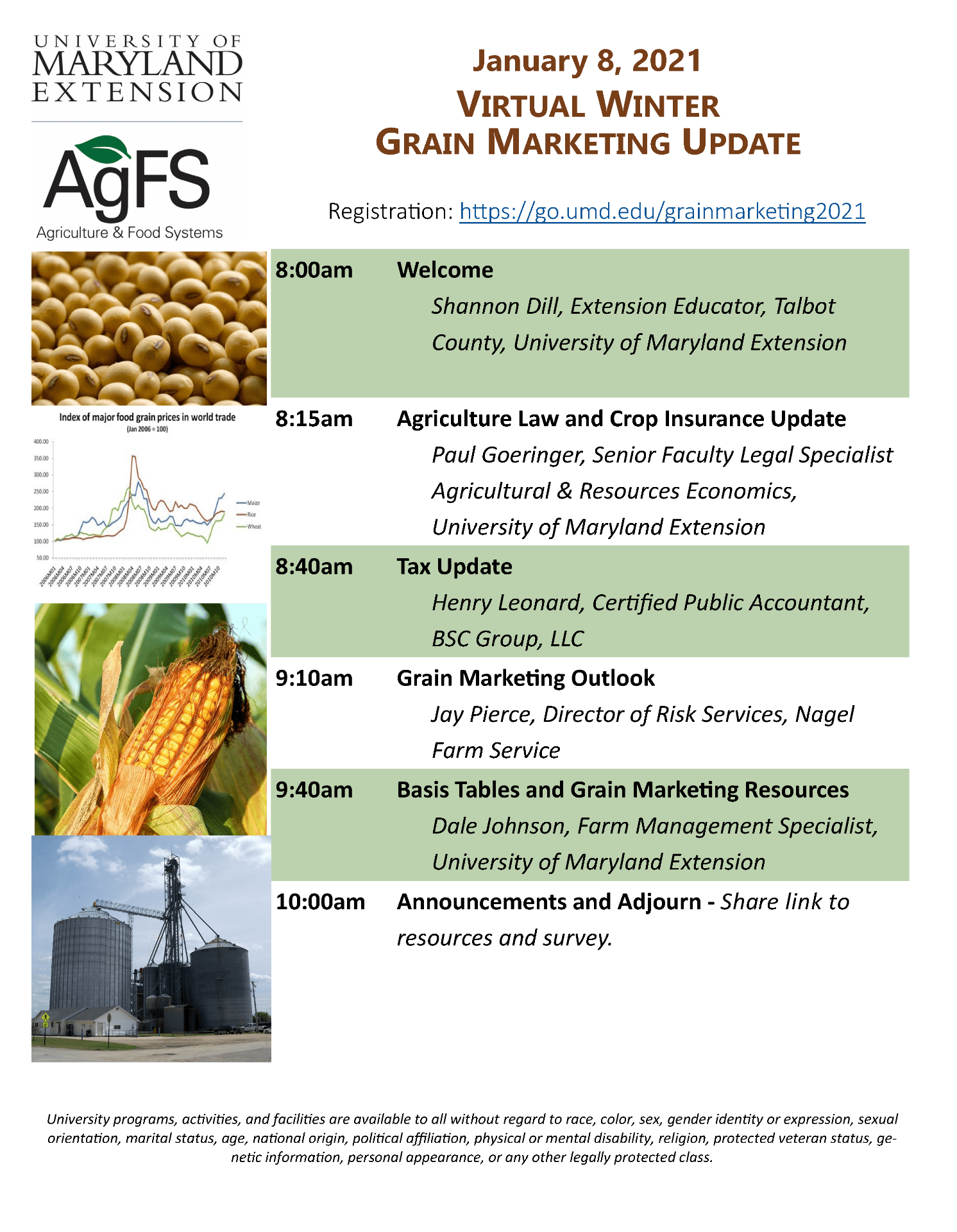

New Extension Program: Frederick County Grain Marketing Meeting The University of Maryland Extension Frederick County will now host a bi-weeky (every-other) meeting to discuss current topics in commodity grain markets for producers looking to improve their grain marketing strategy and stay informed about current market conditions. The meeting is intended to be an open, informal discussion rather than a lecture or presentation. In this, any and all members of the agricultural community/those interested in learning more about commodity grain markets are invited to attend.

Currently, meetings will be held at the Cracker Barrel in Frederick located just off Rt. 85 at 7408 Shockley Drive, Frederick, MD 21704 on Friday mornings from 7:30 am – 8:30 am. The meetings will be held over a delicious breakfast, however attendees will be responsible for purchasing their own meals. The next meeting will be held on Friday, Jul 28, 2023. Meeting location and times may be subject to change to better suit the needs of the attending group and will be announced.

For additional clarity, the current meeting schedule for the next five meetings is as follows:

- July 28, 2023

- August 11, 2023

- August 25, 2023

- September 8, 2023

- September 22, 2023

Attendees or interested parties are encouraged to complete the online form at the Frederick County Extension, Agriculture and Food Systems webpage or at https://go.umd.edu/FrederickGrain. Completion of the form is not required for attendance, however those who complete the form and provide an email address will receive additional information and timely updates of grain marketing topics, news, and market conditions between meetings.

Depending on group interest, expert speakers may be invited to attend and offer additional perspectives on marketing or market conditions at future meetings. For more information, comments, or questions please contact Mark Townsend, Agriculture Agent Associate, at mtownsen@umd.edu or (301) 600-3578. The UME-Frederick Ag&FS team looks forward to your attendance!

###

This institution is an equal opportunity provider.