Nicole Cook, Legal Specialist

University of Maryland, Eastern Shore

This article is not a substitute for legal advice. Reposted from the Ag Risk Blog

On Friday, President Trump signed the new COVID-19 relief bill, the Paycheck Protection Program and Health Care Enhancement Act, 116 Pub Law 139 (April 24, 2020) (“Enhancement Act”). In addition to replenishing funds for the Paycheck Protection Program (PPP), the Enhancement Act directs the Small Business Administration (SBA) to make all agricultural producers with 500 or fewer employees who were operating as of January 31, 2020, who have suffered substantial economic injury as a result of the COVID-19 pandemic, eligible for the Emergency Injury Loan Disaster (EIDL) programs. This includes being eligible for a forgivable $10,000 emergency advance “grant.” As of this posting, we are still waiting to find out when the SBA will start accepting loan applications again. But, you can start gathering the information that you’ll need to apply now!

What’s New?

The EIDL program is administered by the SBA, and as I explained in this article, despite Congress’ original intent in the CARES Act for all farmers and ranchers to be eligible for the EIDL program, the SBA was excluding certain farmers and ranchers from the program.

The EIDL program, as modified by the CARES Act and the Emergency Act, provides EIDL business loans to eligible entities, which now include all types of agricultural producers. This includes non-profit organizations, farmers markets, LLC’s, sole proprietorships, and other small business entities. And, farmers and ranchers, as eligible entities, can also get a forgivable emergency advance on their EIDL loan of up to $10,000, which, like a grant, they don’t have to pay back. The advances are known as “EIDL Emergency Advances” or “Emergency EIDL Grants.”

What Does “Substantial Economic Injury as a result of the COVID-19 pandemic” Mean?

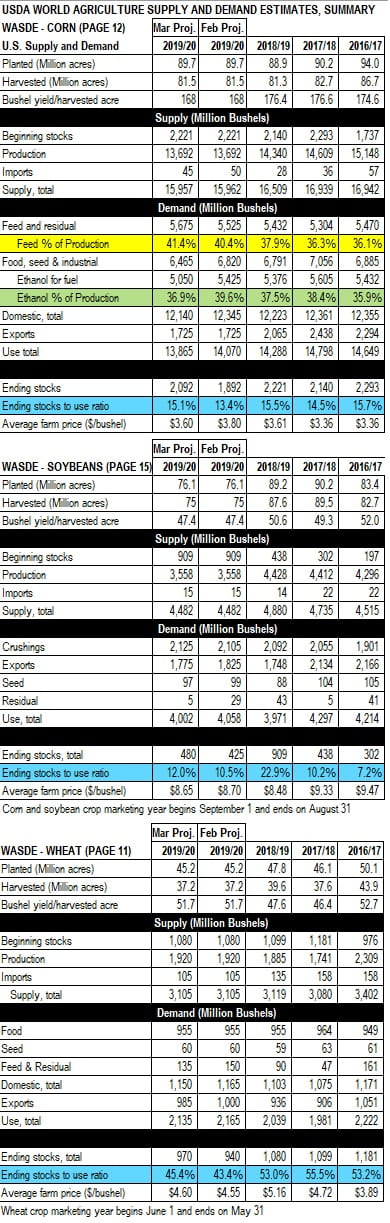

When you apply for an EIDL COVID-19 loan, you will be certifying that your business suffered substantial economic injury due to the COVID-19 pandemic. What that means for you is going to depend on your business. For example, if before the pandemic you sold primarily to farmers markets or restaurants and now as a result of the stay-at-home orders and other measures put in place by government officials those markets are closed or significantly reduced, your are likely going to be able to show that your business suffered substantial economic injury due to the pandemic. Even if you’re shifting your markets to sell direct to consumers online, you are likely still eligible because there are necessarily delays in establishing that change in business model and you might still only be able to resume selling at a significant loss. Other examples are dairy farmers who have lost their markets or grain farmers who are experiencing historic low prices as a result of sharp declines in market demands.

EIDL Loans

You can apply for an EIDL loan for as little or as much as you need up to $2 million. That means that if you only need $10,000, you could request a loan of $10,000 and then apply to receive all of the money in advance as an Emergency EIDL Grant.

Remember that any loan amount above the $10,000 in EIDL Emergency Advances is not forgiven. Interest rates on the loan amount above the $10,000 in Emergency EIDL Grants are 3.75% for small businesses, and 2.75% for non-profit organizations.

The loan terms can be up to 30 years with the first payment not due for 12 months after the funds are issued.

No personal guarantee is required for loans of $200,000 or less. No collateral is needed for loans of less than $25,000, and there is no need to have applied for credit and been denied elsewhere in order to apply.

Emergency EIDL Grants

Eligible entities, which now include all agricultural enterprises, can request that the SBA give them an advance on the loan. The advance can be up to $10,000. (CARES Act § 1110(e)(3); Enhancement Act, § 101(c)). Once approved, the money is supposed to arrive within three days. (CARES Act § 1110(e)(1)-(3)). The Emergency EIDL Grants are completely forgivable. You do not ever have to pay them back.

What Can The Money Be Used For?

EIDL loans are considered working capital loans. They’re meant to help you carry on your business until you can resume normal operations. They can be used for things like (1) to pay fixed debts, (2) to pay sick leave for employees who are unable to work due to COVID-19; (3) to maintain payroll, (4) to pay accounts payable including increased costs of materials due to COVID-19’s supply chain disruptions, and (5) to pay rent or mortgages.

They are not meant to be used for expanding your business, and you can’t spend the money on refinancing debt that you incurred prior to the disaster declaration. You also can’t spend the money to make payments on loans made to other Federal agencies (e.g., FSA loans); pay tax penalties; pay penalties for noncompliance with laws; or pay dividends to shareholders.

You can, however, pay reasonable remuneration for services that are performed for the business. So, if you have a record of making payments to yourself for the work that you do for the business, that is allowed just like covering payroll or spending the money for accounts payable is an approved use of the funds. But, if you don’t have a record of making those payments before the disaster, you might be challenged on making those payments with the loan money.

Can I Participate In Other Federal Relief Programs If I Get An EIDL Loan?

The COVID-19 EIDL programs are meant to compliment the other Federal COVID-19 relief programs like the PPP and the Pandemic Unemployment Assistance program (PUA). (For more information about the PPP, read this post and watch this video. For more information about the PUA, read this article.) You will need to do some calculating to determine whether and which relief programs make the most sense for your business. For example, an EIDL loan might be easier for a new farmer who doesn’t have 2019 income tax returns but who was operating on January 31, 2020, and who does have a few months of sales information. You can participate in all of the programs, but, for example, the portion of the PPP loan amount that is forgiven will be reduced by the EIDL loan amount you receive. And, the government will know that you are participating in more than one program.

When And Where Do I Apply?

Once the site becomes available, you will need to apply for the EIDL program funds online through the SBA’s website. The SBA stopped accepting new EIDL applications when the original CARES Act funding ran out. We don’t know yet when the SBA will resume accepting applications now that the additional funding has been approved under the Enhancement Act, so you will need to check the SBA’s website. Also check this blog. We will post an update once the SBA re-opens the portal for submitting applications.

The deadline to apply for COVID-19 EIDL assistance is December 31, 2020.

What Information Will I Need To Apply?

This is a revenue-protection program. To apply, you will self-certify that you need to borrow the amount of money that you would have used to pay normal expenses during the time of the declared crisis. The SBA will consider your ability to repay the loan amount based on your sales history and existing obligations along with your credit history. You will need your sales history records, then.

Keep in mind that you might not be approved for the full amount you requested, and understand that it may actually take a few weeks to the get the EIDL Emergency Advance money and it might not all arrive at once. These are simply the realities of a large, cumbersome bureaucracy trying to quickly implement these measures.

Tips For Submitting Your Application

The SBA advises applicants to register as new users, and then download and/or print out the application forms so that you can prepare your application offline before going back online to complete and submit your packet. That’s because the site is overwhelmed and there is a good chance that the site will crash while you’re in the middle of completing your application.

Also, once you are entering the data online, be sure to finish and submit your completed application. Incomplete applications will be sent to the back of the line, so you’re application may not be received before the funds run out again.

Once you’ve submitted your application, be sure to check the status of your application online as well as checking your bank account. The SBA has said that it isn’t able to send timely notices out about deposits of funds, but you’ll see the money appear in your bank account shortly after your application has been approved.

More Information

To view slides from the Small Business Administration’s Baltimore District Office’s March 26, 2020, webinar on how to apply for EIDL Loans and Emergency Grants, click here. Remember, the information in the slides and the webinar does not include the Enhancement Act’s updates.

You can find more Maryland-specific information and resources about COVID-19 issues on the Maryland Agriculture Law Education Initiative’s website at umaglaw.org.

An excellent resource for information about all of the federal relief programs available for farmers, including the EIDL programs, is the Farmers’ Legal Action Group’s Farmers’ Guide to COVID-19 Relief (2nd Edition).