Dale Johnson, Farm Management Specialist

University of Maryland

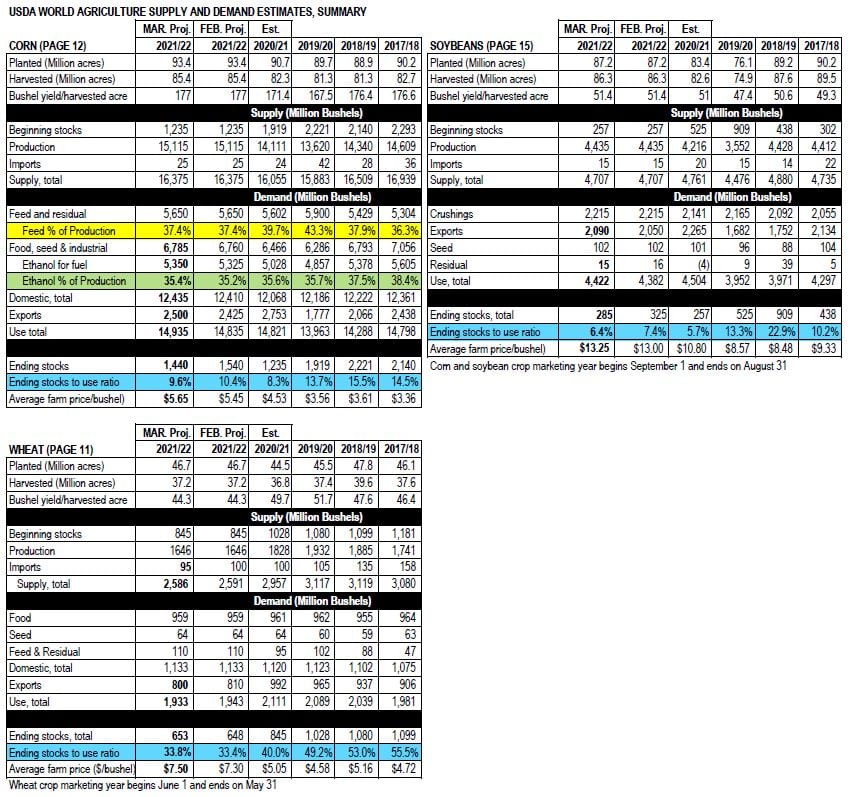

Information from USDA WASDE report

Attached is the summary for the March 2022 WASDE.

Corn

There were no changes on the corn supply side from the February 9 WASDE estimates. On the demand side, ethanol estimates increased 25 million bushel and esports increased 75 million bushel for a total demand increase of 100 million bushel. Ending stocks are estimated to be 1,440 million bushel, decreasing the stocks-to-use ratio from 10.4% in February to 9.6% in March. March 2022 Corn futures increased from $6.47 on February 9 to peak at $8.00 on March 4 and settle back to $7.45 March 9 as extraordinary world events drive market prices up.

Soybeans

There were no changes on the soybean supply side from the February 9 WASDE estimates. On the demand side, export estimates were increased by 40 million bushel and the residual estimate was decreased by 1 million bushel. This resulted in a lower estimate of ending stocks at 285 million bushel and a decrease in the stocks-to-use ratio from 7.4% to 6.4%. March 2022 futures price increased dramatically from $15.95 on February 9 to peak at $17.65 on February 24 and settle back to $16.87 on February 9 as extraordinary world events drive market prices up.

Wheat

On the supply side, import estimates were decreased by 5 million bushel. On the demand side, export estimates were decreased 10 million bushel. These changes increased the ending stocks by 5 million bushel to 653 million bushel and the stocks to use ratio increased from 33.4% to 33.8%. However, extraordinary world events drove March futures from $7.85 on February 9 to peak at 14.25 on March 7. On March 3 & 7, the market was limit up as trading was halted on those days. The market then went limit down on March 8, 9 , & 10. On March 9 &10 there was no trading. The market went limit down at the opening. On March 11 the market closed at $10.90 after the wildest ride in history.