Dale Johnson, Farm Management Specialist

University of Maryland

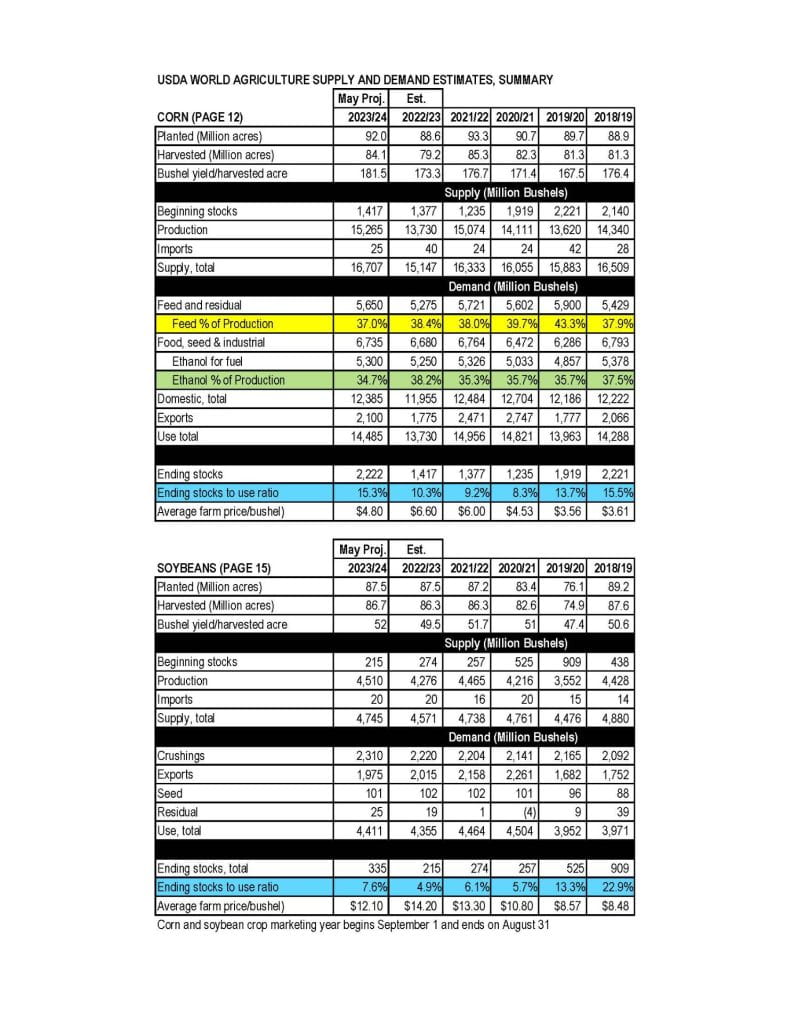

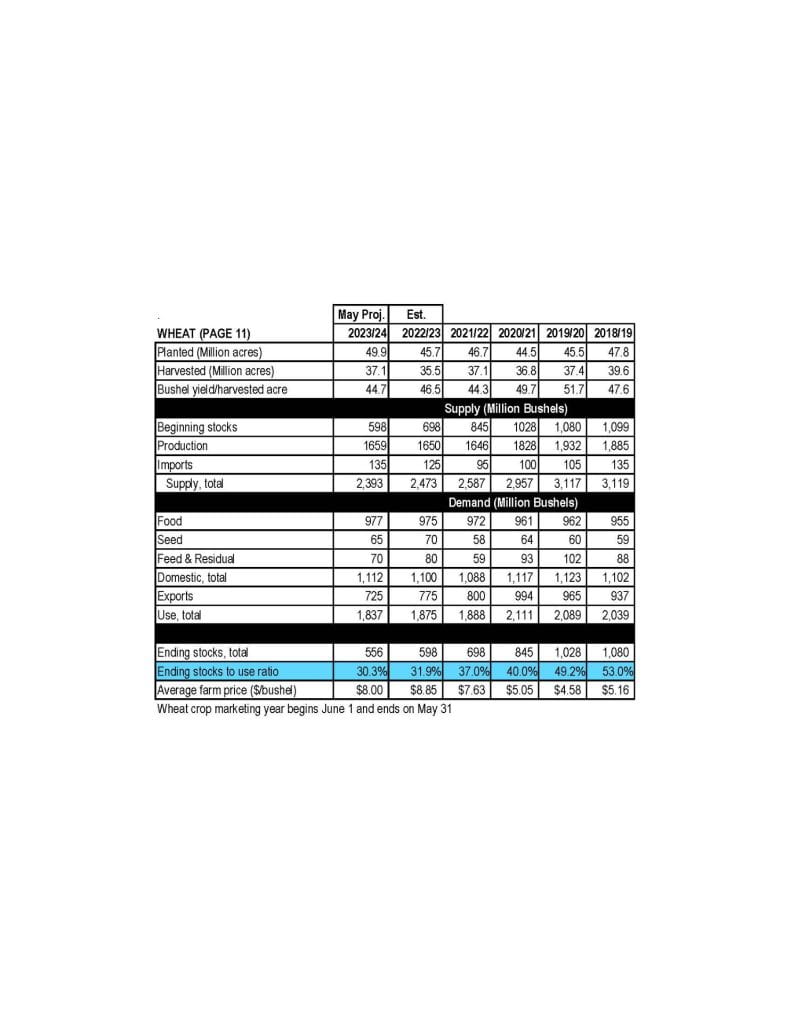

Information from USDA WASDE report

Attached is the summary for the May 2023 WASDE.

Corn

The 2023/24 U.S. corn outlook is for larger production, greater domestic use and exports, and higher ending stocks. The corn crop is projected at a record 15.3 billion bushels, up more than 10 percent from last year on increases to both area and yield. The yield projection of 181.5 bushels per acre is based on a weather-adjusted trend assuming normal planting progress and summer growing season weather, estimated using the 1988-2022 time period. With beginning stocks up slightly, total corn supplies are forecast at 16.7 billion bushels, the highest since 2017/18. Total U.S. corn use for 2023/24 is forecast to rise about 5 percent relative to a year ago on higher domestic use and exports. Food, seed, and industrial use is projected to rise 55 million bushels to 6.7 billion. Corn used for ethanol is projected to increase 1 percent, based on expectations of modest growth in motor gasoline consumption and ethanol’s inclusion rate into gasoline. Feed and residual use is projected higher on a larger crop and lower expected prices. U.S. corn exports for 2023/24 are forecast to rise 325 million bushels to 2.1 billion, as lower prices support a sharp increase in global trade following the decline seen during 2022/23. U.S. market share is expected to increase slightly albeit remain below the average of the past 5 years. Exports are higher for Argentina and Brazil, with the former reflecting a return to normal weather conditions after a drought during 2022/23. Despite a rebound in U.S. exports, Brazil is forecast to be the world’s largest exporter of corn for the second consecutive year. Exports for Ukraine are projected to decline based on lower production prospects. With total U.S. corn supply rising more than use, 2023/24 ending stocks are up 805 million bushels from last year and if realized would be the highest in absolute terms since 2016/17. Stocks would represent 15.3 percent of use, the highest since 2018/19. The season-average farm price is projected at $4.80 per bushel, down $1.80 from 2022/23.

Soybean

Wheat

The 2023/24 outlook for U.S. wheat is for reduced supplies and exports, increased domestic use, and smaller stocks compared with 2022/23. U.S. wheat supplies are forecast lower than last year with smaller beginning stocks and only slightly larger production. All wheat production is projected at 1,659 million bushels, up modestly from last year on increased harvested area. However, the harvest-to-plant ratio is down from last year with above-average abandonment in Texas, Oklahoma, and Kansas. The all wheat yield, projected at 44.7 bushels per acre, is 1.8 bushels lower than last year. The first survey-based production forecast for 2023/24 winter wheat is up 2 percent from last year as higher Soft Red Winter production more than offsets a decline in Hard Red Winter and White wheat. Total 2023/24 domestic use is projected at 1,112 million bushels, up 1 percent from last year, primarily on increased feed and residual use. Exports are projected at 725 million bushels, 50 million lower than last year. Ending stocks are projected 11 percent lower than last year and the lowest in 16 years. The projected 2023/24 season-average farm price is $8.00 per bushel, down $0.85 from last year’s record.