2023 Berkshire Hathaway Annual Meeting: Summary Of The 48 Questions And Answers

Seeking Alpha has published my article:

2023 Berkshire Hathaway Annual Meeting: Summary Of The 48 Questions And Answers

Summary

- Berkshire Hathaway’s annual meeting saw Warren Buffett discuss the company’s Q1 earnings report, with operating earnings equaling $8 billion in the quarter. He expects most of Berkshire’s businesses to report lower earnings in 2023 vs. 2022.

- Buffett and Charlie Munger answered questions on a range of topics, including the economic consequences of Silicon Valley Bank’s deposits not being fully covered, the impact of AI and robotics, and the outlook for commercial real estate.

- The meeting also covered Berkshire’s investments in companies like Apple, Geico, and BNSF, with Buffett praising.

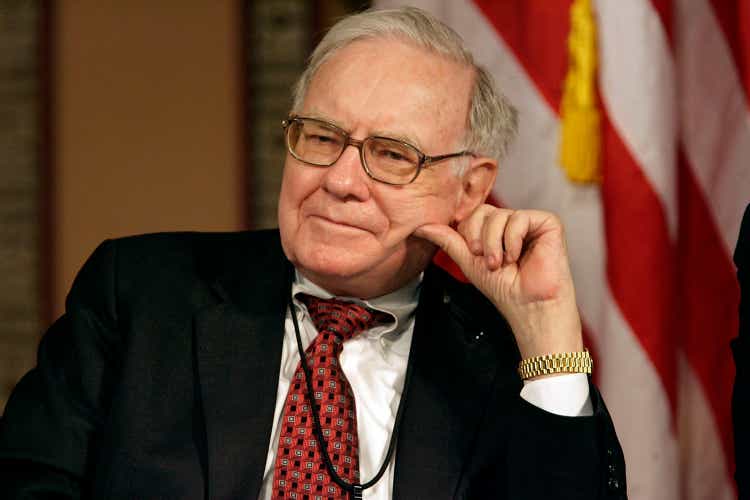

Chip Somodevilla

Berkshire Hathaway Annual Meeting

May 6, 2023

(Notes taken by Professor David Kass, Department of Finance, Robert H. Smith School of Business, University of Maryland)

Approximately 40,000 shareholders attended the annual meeting.

A humorous film was shown including a variety of commercials of businesses owned by Berkshire including Apple and Geico. Jamie Lee Curtis appeared in a skit that was initially shown at the 2006 annual meeting. She then appeared in an updated version from 2023.

Warren Buffett (92) is on the stage along with Charlie Munger (99), Greg Abel (61) and Ajit Jain (71).

Buffett discussed Berkshire’s first quarter earnings report. Operating earnings equaled $8 billion in the quarter. He expects most Berkshire’s businesses to report lower earnings in 2023 vs. 2022.

Questions were submitted by shareholders to Becky Quick of CNBC who alternated with the audience.

Q1. Becky Quick: If Silicon Valley Bank’s deposits had not been fully covered, what do you think the economic consequences would have been to the nation?

Buffett: It would have been catastrophic. That’s why they were covered. It was inevitable. Similarly, the U.S. would not let the debt ceiling to cause the world to go into turmoil. Charlie, do you have anything?

Munger: No, I have nothing to add.

Q2. Audience: Mr. Buffett, Mr. Munger, do you ever make bad decisions because of your emotions?

Buffett: We make bad decisions all the time, but we do not make emotional decisions.

Q3. Quick: Last year I asked you about how GEICO and BNSF appeared to lose ground to their leading competitors, GEICO on telematics and BNSF on precision scheduled railroading. Ajit and Greg, how is Berkshire addressing these challenges?

Jain: Geico has introduced telematics for pricing on 90% of its new business. Unfortunately, less than half of that is being taken up by the policyholders. Geico’s technology needs a lot more work. It has 600 legacy systems that don’t talk to each other. In terms of matching rate to risk, Geico is still a work in progress. There is a trade-off between profitability and growth, and we are going to emphasize profitability and not growth. And that will come at the expense of policyholders. It will not be until two years from now that we’ll be back on track.

Abel: We will focus on delivering long term value and service to our customers. (BNSF)

Buffett: Todd Combs was Ajit’s choice, and my choice, to go back to Geico to work on the problem of matching rate to risk, which is what insurance is all about. And he arrived with exquisite timing, right before the pandemic broke out and all kind of things changed. Todd is doing a wonderful job at Geico. And he works closely with Ajit. He has a home in Omaha, he comes back here, and we get together on weekends sometimes. He’s made a very big change in multiple ways at Geico. Berkshire Hathaway Specialty has been very successful under the leadership of Peter Eastwood.

Q4. Audience: What are positive and negative impacts of AI and robotics?

Munger: BYD’s factories in China have robotics at an unbelievable rate. We are going to see a lot more robotics. I am skeptical of some of the hype that has gone into artificial intelligence. I think old-fashioned intelligence works pretty well.

Buffett: There won’t be anything in AI that replaces Ajit. When something can do all kinds of things, I get a little bit worried because we won’t be able to un-invent it. AI can change everything in the world except how men think and behave.

Q5. Quick: What is the outlook for commercial real estate and its impact on banks, and is Berkshire active in this area?

Munger: Berkshire has never been active in commercial real estate. The hollowing out of downtowns in the U.S. and elsewhere in the world is going to be quite significant and quite unpleasant. I think the country will get through it all right, but it will often involve a different set of owners.

Buffett: The lenders are the ones that get the property. And, of course they don’t want the property, usually, so the real estate operator counts on negotiating with them, and the banks tend to, you know, extend and pretend. But it all has consequences.

Q6. Audience: How can investors succeed with disruptive technologies and AI?

Munger: Value investors are going to have a harder time now that there are so many of them competing for a diminished bunch of opportunities. My advice to value investors is to get used to making less.

Buffett: We never thought we could manage $508 billion. There are going to be plenty of opportunities. What gives you opportunities is other people doing dumb things. Opportunities will be greater if you are running small amounts of money.

Munger: There is so much money now in the hands of so many smart people, all trying to outsmart one another and are short term oriented.

Q7. Quick: Question about Berkshire’s 2016 agreement with AIG where Berkshire assumed up to $20 billion in liabilities in exchange for $10 billion upfront.

Buffett: Berkshire merged the $10 billion in a general pool of assets. We account for 26% of the net worth of all property casualty companies in the U.S. So far, the payments that we have had to make have run modestly, slightly below the amount we anticipated having to pay in terms of our share of the losses.

Jain: The actual payments are 96% of what we had projected to pay out at this point in time, which is good but not great. If we end up paying less than what we projected, not only would we have borrowed money at a very attractive rate, significantly less than 4%, in addition to that we would have made a fee, which in 2015 dollars would be $1 million.

Munger: Within Berkshire the casualty insurance companies have four times as much stockholder capital behind each dollar of premium value. Four times normal. Of course, we see the big deals. Who would you trust if you had a big liability you wanted to dump on somebody?

Buffett: We have $25 billion more coming in from things other than insurance every year with no obligations. It’s a business where people are counting on you to pay.

Q8. Audience: How do you prepare the next generation for the inheritance of a family business coming their way?

Buffett: Discuss your will with your children.

Q9. Quick: A federal judge ruled in March that BNSF intentionally and illegally violated an easement agreement on tribal land in Washington State by transporting long trains of crude oil. The same morning the judge made his ruling, a BNSF train derailed on tribal land, spilling oil in an environmentally sensitive area. How do BNSF and Berkshire’s subsidiaries fulfill their ethical responsibilities?

Abel: We had significant discussions with the tribe looking to resolve the issues, recognizing we obviously benefitted from moving those trains. Those discussions will continue. There are lessons learned there that we have to, when we make a commitment, understand what that commitment is and live by it. On the derailment side, we worked very closely with the tribe to mitigate that issue instantly or at least over a reasonable period of time. They were very responsive. There are over 1000 derailments per year. The systems were designed in the late 1800’s. We have 22,000 miles of track. It’s not an easy business. We’ll make mistakes. We have to carry certain products we wish we didn’t have to carry. We are a common carrier. Do we like carrying chlorine and ammonia? No. We load them if they select our railroad. We are better than we used to be. But we’ve got a long way to go.

Q10. Audience: What are your thoughts on the development of clean energy?

Abel: This is a state by state issue. By 2030 we will reduce carbon footprint by 50% relative to 2005. That’s the Paris Accord.

Q11. Quick: Who is currently behind Greg Abel and Ajit Jain?

Buffett: Greg will make that decision.

Q12. Audience: What are some of the most important things for the U.S. to remain strong?

Buffett: The U.S. is capable of doing remarkable things.

Munger: I’m slightly less optimistic than Warren is. We have too many young and brilliant people going into wealth management.

Q13. Quick: Are you concerned that a corporate raider like Carl Icahn would buy up Berkshire’s shares after Warren is no longer here?

Buffett: Eventually Greg and the directors will be judged based on how well our operation fares versus others. Berkshire will be judged as a national asset rather than a national liability. I think we win out if we deserve to win out.

Q14. Audience: Please share a couple of stories about Greg and Ajit that capture their character and caliber as leaders.

Buffett: Berkshire’s reinsurance operation from 1969 – 1986 was going nowhere. Ajit walked in on a Saturday morning for a job interview. He knew nothing about insurance but had experience in management consulting. After talking to him, I knew I’d struck gold. So, I hired him and gave him the backing of some money. We hit a very good period in the market almost right away for him to act. You cannot replace Ajit. We still enjoy talking.

Q15. Quick: Why isn’t Berkshire deploying its capital in cat reinsurance now and what is the impact of the Alleghany acquisition on reinsurance?

Jain: Alleghany will continue to run its own reinsurance business. On April 1, a big renewal date, prices were very attractive so we now have a portfolio that is very heavily exposed to property catastrophe. Our exposure today is almost 50% more than 6 months ago. I think we have written as much as our capacity will allow us to write. However, if there is a big hurricane in Florida, we could lose as much as $15 billion. If there isn’t a loss, we will make several billion dollars as profit. Given that we have a little less than $300 billion of capital, we think of that ($15 billion) a 5% exposure that we’re willing to take on.

Q16: Audience: What advice can you give CEOs about the tradeoff between short term and long term profits?

Buffett: We feel no pressure from Wall Street. We don’t make promises. We are working for our shareholders. We are interested in owning a wonderful business forever. We learn as we go along. We know what the right price is, and we know what we think we can project out in terms of consumer behavior and threats to a business.

Munger: Tell them about the Japanese companies.

Buffett: The Japanese companies were earning 14% on what we were going to pay to buy them. They were paying decent dividends. They were going to repurchase shares in some cases. They owned a whole bunch of businesses that we could understand as a group. We could take out currency risk by financing in Japan at ½%. If you get 14% on one side and a half a percent on the other side, you have money forever and they are doing intelligent things and they are sizable so we just start buying them. When we hit 5% in all of them, we announced on my 90th birthday that we owned over 5%. Recently we went over for the first time to visit them. We were more than pleasantly surprised, Now we own 7.4% of them and we will not go over 9.9% without their agreeing. We are $4 or $5 billion ahead plus dividends. I went over there partly to introduce Greg to those people because we are going to be with them 10, 20, 30, 40, years from now. They may occasionally find something that we can do jointly. Berkshire is the largest borrower other than corporate borrowers, outside of Japan.

Q17. Quick: Professor Damodaran (NYU) is not comfortable with positions becoming a large part of his portfolio, Since Apple is now over 35% of Berkshire’s portfolio, is that a problem?

Munger: I think he is out of his mind.

Buffett: Apple is not 35% of Berkshire’s portfolio. Berkshire’s portfolio includes the railroad, the energy business, Garanimals, See’s Candies, etc. They are all businesses. The good thing about Apple, our stake can increase. They buy in their stock, and instead of owning 5.6% we get to 6%. But we can’t own more than 100% of the BNSF. Apple is a better business than any we own. People pay $1,500 for a phone and $35,000 for second car. If they had to give up a second car or give up their iPhone, they would give up their second car.

Munger: I think one of the inane things taught in modern university education is that a vast diversification is absolutely mandatory in investing in common stocks. That is an insane idea. It is not that easy to have a vast plethora of good opportunities that are easily identified. And if you’ve only got three, I’d rather be in my best ideas instead of my worst. We make fewer mistakes than other people. We are not so smart, but we know the edge of our smartness. That is a very important part of practical intelligence. If you know the edge of your own ability, you should ignore most of the notions of our experts about what I call “deworsification” of portfolios.

Q18: Audience: Question about U.S./China geopolitical tensions.

Munger: We should have a lot of free trade with China in our mutual interest. Think of what Apple has done by engaging in a partnership with China as a big supplier. Everything that increases the tension between the two countries is stupid, stupid, stupid.

Buffett: You have the two superpowers of the world, and they know they have to get along with each other. Either one can destroy the other. And they are going to be competitive with each other.

Q19. Quick: Why did Berkshire sell $5 billion of Taiwan Semiconductor within a few months of buying it?

Buffett: Taiwan Semiconductor is one of the best managed and important companies in the world. And I think you will be able to say the same thing in 5, 10, or 20 years. I don’t like its location. I feel better about the capital that we have deployed in Japan than Taiwan.

Q20. Audience: A shareholder quotes Ben Graham and asks what is your 100-year vision of Berkshire?

Buffett: Praises Ben Graham’s 1949 book.

Munger: More than half of Ben Graham’s investment return in his whole life came from one growth stock – Geico (currently owned by Berkshire).

Buffett: The willingness to act when you need to act and the willing to ignore every salesman in the world – and it’s imperative to ignore them, and it’s one or two things that make the right decision. If you make the right decision on a spouse, you have won the game. The thing to do is just keep trying to think things through and not do too many stupid things. And sooner or later you have a “lollapalooza” as Charlie would say.

Q21. Quick: Car manufacturers (Tesla and GM) are offering insurance to purchasers of electric vehicles. What will Geico do to compete?

Jain: Geico is talking to a number of original equipment manufacturers as well to try and see how best they can work with them to offer insurance at the point of sale. There have not been many success stories. Data needs to be collected on the driver, not just the car.

Buffett: This is not a new idea. It is hard to come up with something that is better at matching risk to price which is what very smart people at Progressive and Geico are doing. Uber lost a lot of money trying to do this.

Jain. The margins on writing auto insurance are 4%, which is a very small number.

Buffett: State Farm entered car insurance in 1920 and created a system where it took 20 points out of cost. It now has more net worth (other than Berkshire) than anyone else in the industry.

Q22. Audience: Will institutions have voting control of Berkshire in the future and get their way with the ESG checkboxes?

Buffett: The large funds have backed off a lot.

Q23. Quick: Will Greg be making share repurchase decisions in the future?

Buffett: Greg will be doing this in the future.

Abel: We will use the same framework in the future as in the past.

Buffett: Grow present businesses, buy additional businesses. Make decision on dividends. But that decision becomes irrevocable because you do not cut dividends without having a major effect on your shareholder base. If you have ample capital and you are not using it otherwise and your stock is attractive, repurchasing it enhances the intrinsic value for the remaining shareholders. If the price is above intrinsic value, do not repurchase it.

Q24. Audience: Charlie, do you still think people who refused the Covid vaccine were “really massively stupid”?

Munger: Yes.

Q25. Quick: Once the “second men” are running Berkshire, what would you advise owners of Berkshire to watch for? Specifically, what actions, if taken, should give us concern?

Buffett: I feel 100% comfortable with Greg. He is inheriting a good business and I think he will make it better. It’s hard to judge successor management in a really good business.

Lunch Break

Q26. Audience: What is the outlook on the banking industry?

Buffett: Fear is contagious always. Historically, sometimes the fear was justified, and sometimes it wasn’t. My dad lost his job in 1931 because of a bank run. If you saw people lining up at a bank, the proper response was to get into the line. We did something enormously sensible when we set up the FDIC (1934). As many as 2,000 banks had failed in one year after World War I. Although there is a debt ceiling, it’s going to get changed. Although there is a $250,000 limit on FDIC, the U.S. government and the American public have no interest in having a bank fail and have deposits actually lost by people. No one wants to take up my $1 million bet on whether the public will lose money if they have a demand deposit at a bank, no matter the size. We keep our money in cash and Treasury Bills at Berkshire because we keep $128 billion (at the end of Q1). Today, if you press a button you don’t have to get in line and wait for days and have the teller counting our money slowly. You are going to have a run in a few seconds. First Republic was offering non-government guaranteed mortgages in jumbo amounts at fixed rates sometimes for 10 years before they changed to floating. The CEO gets the bank in trouble. Both the CEO and the directors should suffer. The stockholders of the future should not suffer. They didn’t do anything.

Munger: I liked it when banks did not do any investment banking. Depositors will not lose money. Stockholders and debt holders, the holding company should lose money. People have been borrowing on 100% margin with commercial real estate.

Q27. Quick: What do you think of the business models for the big banks as compared to the regional banks?

Buffett: If you follow sound banking methods, a bank can be a perfectly decent investment. We were going to buy banks until the Bank Holding Company Act of 1970 forced us to divest the one bank we had bought. Banking was more attractive to us than insurance. I’ve got my own money with a local bank probably above the FDIC limit. I don’t worry about it in the least. We do have a large investment in Bank of America. I like the management. I proposed the deal with them.

Q28. Audience: (13 year old) Are we likely to face a time in the future when the U.S. dollar is no longer the global reserve currency? How is Berkshire prepared for this possibility? What can American citizens do to shelter ourselves from the beginning of de-dollarization?

Buffett: We are the reserve currency. I see no option for any other currency. Nobody understands the situation better than Jay Powell. But nobody knows how far you can go with a currency before it gets out of control. Your best defense is your own earning power. The best investment is always yourself.

Q29. Quick: The amount paid this year for the 41.4% stake in Pilot values the entire company at around $19 billion. Was it a big mistake to base the final price in 2022 earnings, which has unusually high fuel margins?

Buffett: We arranged to buy it in three stages, with the third stage (20%) being at the option of the owner. The first stage we bought at what turned out to be a very attractive price. The second stage turned out to be a very good year for the diesel business, which means that the seller got a very good price. Overall we feel very good about the fact that we own the 80% at the price that we do, but we would’ve been better if we just bought the 80% to start with. The last 20% the seller has the option, and that is always an unintelligent way of structuring something. The new CEO is Adam Wright who came from Omaha. He almost set the rushing record in football at the University of Nebraska. He held 3 jobs as a student. His mother worked to put him through school. It’s Horatio Alger-squared.

Q30. Audience: (15 year old) What major mistakes we should avoid in both investing and in life?

Buffett: You just want to make sure you don’t make any mistakes that take you out of the game. You should never have a night when you are worried about investing. You should just spend a little less than you earn. You can spend a little more than you earn and then you have debt and the chances are you will never get out of debt. I’ll make an exception in terms of the mortgage on your house. If you are paying 12% or 14% on a credit card, you are saying “I’m going to earn more than 12% or 14% of my money.” And if you can do that, come to Berkshire Hathaway. Tom Murphy’s advice “Praise by name, criticize by category”. Who do you like that criticizes you all the time? I’ve never known anybody who was basically kind that died without friends. You should write your obituary and then try to live up to it.

Munger: Spend less than you earn, invest shrewdly, and avoid toxic people and toxic activities . Keep learning all of your life. Do a lot of deferred gratification.

Q31. Quick: One of the key lessons you have learned to be able to live a happy life and a successful life is to stay away from negative people. My question is what to do if those negative people are your families, the people whom you can’t simply stay away from?

Buffett: If you have a father who won’t be there for you, it’s a very tough problem. I think that one way or another I probably would have gotten through with that, if I had that situation, but I think my life would have been a lot different.

Q32. Audience: How does Berkshire decide some items are sold at some retailers exclusively (Garanimals at Walmart), versus others are sold at many retailers (Fruit of the Loom)?

Buffett: You would love to control the distribution. You are probably going to get better gross margins if they ask for you by name. An example is Coca-Cola, which spent a lot on advertising. On the other hand, Hershey’s didn’t spend any money on advertising. See’s does not travel. Hershey’s chocolate didn’t travel. What is popular in the U.K. isn’t popular in the U.S. Coca-Cola travels. There are 200 countries roughly, and probably in 180 of them it’s the dominant product.

Q33. Quick: Berkshire owns 94 million shares of Paramount Global. Its earnings reports have disappointed. This week it slashed its dividend by 80%. How do you see the streaming wars evolving? Do you still have conviction in your investment thesis? Is your investment thesis based on the company being an acquisition target or based on fundamentals?

Buffett: We are not in the business of giving stock market advice to people. But it is not good news when a company passes its dividend or cuts its dividend dramatically. The streaming business is extremely interesting to watch because people love to use their iPhones watching, being entertained on a screen in front of them. But there are a lot of companies doing it. You need higher prices or it doesn’t work.

Munger: The movie business is one tough business.

Buffett: Theaters are now doing 70% of the business that they did before the pandemic. But you can’t reduce the supply. People have only got so many hours in the day.

Q34. Audience: Why hasn’t Berkshire Hathaway Energy invested in the future by accelerating retirement plans for coal plants?

Buffett: In Iowa we have produced more wind energy than is the total amount of energy used by our customers. But it is not producible 24 hours a day necessarily. We have one other major company in Iowa. Our prices are significantly lower. Our record in wind and solar has not been topped by any utility in the U.S. Most utilities pay out 70% or 80% of earnings and dividends. We haven’t taken a common dividend in 20 years. We reinvested many billions.

Q35. Quick: The WSJ reported in March that oil producers are producing less oil and may have reached their peak in the Permian Basin. Given the major positions of both Occidental Petroleum and Chevron in the Permian, please explain the rationale for Berkshire’s significant holdings of both of those companies, considering the future outlook for oil there.

Buffett: We love the position with Occidental and we love having Vicki Holub running it. There is speculation about us buying control. We’re not going to buy control. We’ve got the right management running it. We wouldn’t know what to do with it.

Munger: There is no oil basin in the US that compares to the Permian. The shale oil was there.

Buffett: We will not be making any offer for control of Occidental. But we love the shares we have. We may or may not own more shares in the future. We have warrants which we got as part of the original deal at around $59 per share. And the warrants last a long time. I’m glad we have them.

Q36. Audience: Does Elon Musk overestimate himself?

Munger: Yes. But he is very talented.

Buffett: Elon is brilliant and may have an IQ greater than 170.

Munger: He would not have achieved what he has in life if he hadn’t tried for unreasonably extreme objectives.

Q37. Quick: Do you feel confident of the future prospects for our over $100 billion in cash on hand, or are we getting closer to cash distributions?

Buffett: If Berkshire shares are selling for less than we think they are worth, that could be a pretty big way to distribute cash. But what we would really like to do is buy great businesses. If we could buy a company for $50 billion, or $75 billion, $100 billion, we could do it. It would be easier with a private company. And there aren’t many that are big. If market circumstances result in us being able to buy $50 billion of our own stock, we’ll buy it. It isn’t killing us to hold $130 billion of bills at 5% plus bond equivalent yields.

Q38. Audience: Question on how to succeed as a lawyer.

Munger: I don’t have a lot of advice about how to succeed as a lawyer.

Q39. Quick: Question about the new 15% corporate minimum tax rate.

Buffett: The 15% tax doesn’t bother me in the least. We were paying 52% tax as federal income taxes when I bought control in the partnership of Berkshire Hathaway. The tax rate has come down dramatically. We do not think corporations are overtaxed in the U.S. We will figure out a way to pay 15% every year, which generally, we’ve been paying anyway. If there were 1000 corporations in the U.S. that paid what Berkshire has been paying, nobody else in the U.S., no individual, no corporation, would ever pay any income tax, social security tax, gift tax, estate tax, anything else. A thousand like Berkshire would produce the revenue that’s being derived under the present tax code from everybody in the U.S.

Q40. Audience: What is the hardest part of your business?

Buffett: We don’t have a hard business. We love our business. I work with the greatest group of people you can imagine. We like each other. Nobody is after anybody else’s job. It’s 5 minutes from my home.

Q41. Quick: “This question comes from David Kass, who is a professor at the business school at the University of Maryland. He says: “At last year’s annual meeting, Warren mentioned that Berkshire had taken a large stake in Activision Blizzard as a merger arbitrage play. Since the UK regulator has blocked its acquisition by Microsoft, has Berkshire reduced or sold its stake?”

Buffett: In terms of what we do with stocks, we don’t give information except when required to, which is in the 13F, or whatever we file. But I would say this, I think Microsoft has been remarkably willing to cooperate with governing bodies. They want to do the deal. They have met the opposition more than halfway. The U.K. is in a better position to block it than the U.S. I don’t know how it turns out. But not everything that should happen does happen. I think the British government is making a mistake in this case.

Q42. Audience: How does Berkshire incentivize owners of its subsidiaries to give up their independence?

Buffett: We hope to find managers who love their business but don’t like a lot of what comes with a public company. There’s nothing like working for yourself. If you can’t own a big company, working at Berkshire running a company is the closest thing you will get. You don’t have to spend time courting analysts who you will probably have contempt for in many cases. You don’t have to spend time with banks getting money and particularly in terrible times. Maybe you have siblings who want out. You may not be able to achieve that unless you sell to Berkshire.

Q43. Quick: Please give an update on See’s Candies and NetJets.

Buffett: See’s is a wonderful brand that does not travel. In the East people prefer dark chocolate to milk chocolate. In the West people prefer milk chocolate to dark. In the East, you can sell miniatures…NetJets is a service to people that have to be very well to do to use it. But if you are very well to do, in effect, you are spending your heir’s money. NetJets has 600 or 650 planes, but we are going to buy 100 planes this year. And we won’t sell any because we’ve got a backlog. And we took a NetJets flight to Tokyo and we flew back. NetJets does not have a competitor. We had looked at Wheels Up the other day. Its stock came out at $10 a couple of years ago. It was selling at 48 cents the other day. When you have money to do NetJets, you know you will get the same planes with the same pilots as I and my family have flown on since before we bought the company.

Q44. Audience: Do you see any opportunities in zero-emission vehicles manufacturers or in related technologies?

Buffett: The auto industry is just too tough. It is a business with a lot of worldwide competitors. We like our dealership operation, but I don’t think I can tell you what the auto industry will look like 5 or 10 years from now.

Munger: The electric vehicle is coming big time. It is imposing huge capital costs and huge risks. And I don’t like huge capital costs and huge risks.

Buffett: I think I know where Apple is going to be in 5 years or 10 years and I don’t know where the car companies are going to be in 5 or 10 years.

Q45. Quick: Does the current size of the Federal Reserve balance sheet concern you?

Buffett: I don’t think the Federal Reserve is the problem and I think they can’t solve the fiscal problem. I do not worry about the Federal Reserve. I think it is fulfilling the functions for which it was established.

Munger: If you are going to just keep printing money and spending it, I think it eventually causes bad trouble.

Buffett: The Fed has two objectives in terms of employment and inflation. But they are not the ones that could create the deficits.

Q46: Audience: Should companies move production away from Asia where supply chain shortages occurred during the pandemic?

Munger: If you can make things in Mexico much cheaper it’s natural to open a factory in Mexico. A lot of auto companies have done that. We have to make sure that we have the best system that takes care of the people who get displaced.

Buffett: The U.S. is 25% of world GDP starting with ½% of the population and did it in a few centuries. The system worked pretty well.

Q47. Audience: Can Mr. Buffett elaborate on why he views mark-to-market accounting differently for banks in comparison to Berkshire.

Buffett: I believe in both cases in doing it on the balance sheet and not in the income statement. We show it on our balance sheet. We believe in showing market values on our balance sheet. We just don’t believe in running it through the income account. We’ll consistently do what is legal and we’ll consistently say what we think is right. I thought EBITDA was about as bad as you could get. But they kept going. You know Earnings Before Everything, EBE. We want owners who understand what they own.

Q48. Audience: How do you transfer your wisdom to your grandchildren and heirs?

Munger: I just live my life my own way and they can observe it as an example if they want to. And if they don’t, they can try some other way. And I have to pretend I like some of the boyfriends and girlfriends I don’t like. Usually, I just bite my tongue and keep silent.

Meeting Adjourned

In conclusion, Warren Buffett made several positive comments with respect to five of Berkshire’s top six equity holdings: Apple, Bank of America, Coca-Cola, Chevron, and Occidental Petroleum.

In my opinion, Apple has an extremely bright future with a very loyal customer base within its ecosystem. Representing almost 50% of Berkshire’s equity portfolio and the first company with a $3 trillion market capitalization, Apple does not only have excellent growth opportunities, but it is also returning capital to shareholders in the form of cash dividends and a large share buyback program.

Bank of America, Berkshire’s second largest equity holding, is a very well run bank under the leadership of its CEO, Brian Moynihan.

Coca-Cola, Berkshire’s fourth largest equity investment, has been a mainstay in its portfolio since 1988. Its dominant role in 180 countries should enable it to continue to grow in the foreseeable future.

Chevron and Occidental Petroleum, Berkshire’s fifth and sixth largest holdings respectively, as of March 31, have large stakes in the Permian Basin. The outlook for Occidental is especially bright, with CEO Vicki Hollub promising to invest in projects only where the return on capital exceeds the cost of capital and to use its free cash flow to pay down its debt and buy back its common and preferred stock. Warren Buffett has been adding to its 25% stake in recent weeks.

Finally, Berkshire itself is very well positioned for the remainder of 2023. Currently, its shares are up 11% year-to-date, substantially exceeding the Dow Jones Industrial Average (+2%), but trailing the large tech company influenced S&P 500 (+15%). Its BNSF railroad, Berkshire Hathaway Energy, manufacturing operations, and its insurance businesses led by Geico, should achieve good results going forward.