This blog post is coauthored with Wesley Look (Resources for the Future) and Cole Martin (Resources for the Future).

The bipartisan infrastructure bill that President Joe Biden signed late last year includes some provisions to cut greenhouse gas emissions from the transportation sector; for example, funding for electric vehicle charging infrastructure. And the Build Back Better Act, also known as the budget reconciliation bill, includes subsidies for a vast array of clean energy technologies. Together, the two laws could transform the transportation sector, although the fate of the Build Back Better Act is highly uncertain.

A lot of reporting has covered subsidies for electric passenger vehicles and investments in charging infrastructure and public transportation—but what has gotten substantially less attention is that Congress may create entirely new subsidies for electric trucks, as well. The Build Back Better Act would create a first-ever electric vehicle tax credit for commercial vehicles, including medium- and heavy-duty vehicles (MHDVs). A diverse class of vehicles, MHDVs include vehicles like large pickup trucks, garbage trucks, and long-haul freight vehicles—and MHDVs could be a crucial component of the Biden administration’s decarbonization goals, as these vehicles produce about 23 percent of all US transportation sector emissions.

Recent legislative proposals for subsidizing MHDVs, such as the Clean Energy for America Act, offer tax credits for commercial MHDVs amounting to 30 percent of the cost of each electric vehicle. To see how these subsidies would affect vehicle purchases, emissions, and the federal budget, two of us—Joshua Linn and Wesley Look—have collaborated with researchers at Oak Ridge National Lab to model the subsidies. We consider: a between 2020 and 2030; a “low-technology” case with a 30 percent investment tax credit (ITC) for new electric vehicle purchases and a similar 30 percent ITC for vehicle charging infrastructure, alongside the and a “high-technology” case with the same 30 percent ITCs as the low-technology case but with vehicle costs falling by 70 percent between 2020 and 2030.

Recent legislative proposals for subsidizing MHDVs, such as the Clean Energy for America Act, offer tax credits for commercial MHDVs amounting to 30 percent of the cost of each electric vehicle. To see how these subsidies would affect vehicle purchases, emissions, and the federal budget, two of us—Joshua Linn and Wesley Look—have collaborated with researchers at Oak Ridge National Lab to model the subsidies. We consider: a between 2020 and 2030; a “low-technology” case with a 30 percent investment tax credit (ITC) for new electric vehicle purchases and a similar 30 percent ITC for vehicle charging infrastructure, alongside the and a “high-technology” case with the same 30 percent ITCs as the low-technology case but with vehicle costs falling by 70 percent between 2020 and 2030.

Recent legislative proposals for subsidizing MHDVs, such as the Clean Energy for America Act, offer tax credits for commercial MHDVs amounting to 30 percent of the cost of each electric vehicle. To see how these subsidies would affect vehicle purchases, emissions, and the federal budget, two of us—Joshua Linn and Wesley Look—have collaborated with researchers at Oak Ridge National Lab to model the subsidies. In a new RFF Issue Brief, we consider three scenarios: a “baseline” with no subsidies for electric trucks and in which total electric vehicle prices decline by 40 percent between 2020 and 2030; a “low-technology” scenario case with a 30 percent investment tax credit (ITC) for new electric vehicle purchases and a similar 30 percent ITC for vehicle charging infrastructure, alongside the same price decline as the baseline; and a “high-technology” case with the same 30 percent ITCs as the low-technology case but with vehicle costs falling by 70 percent between 2020 and 2030.

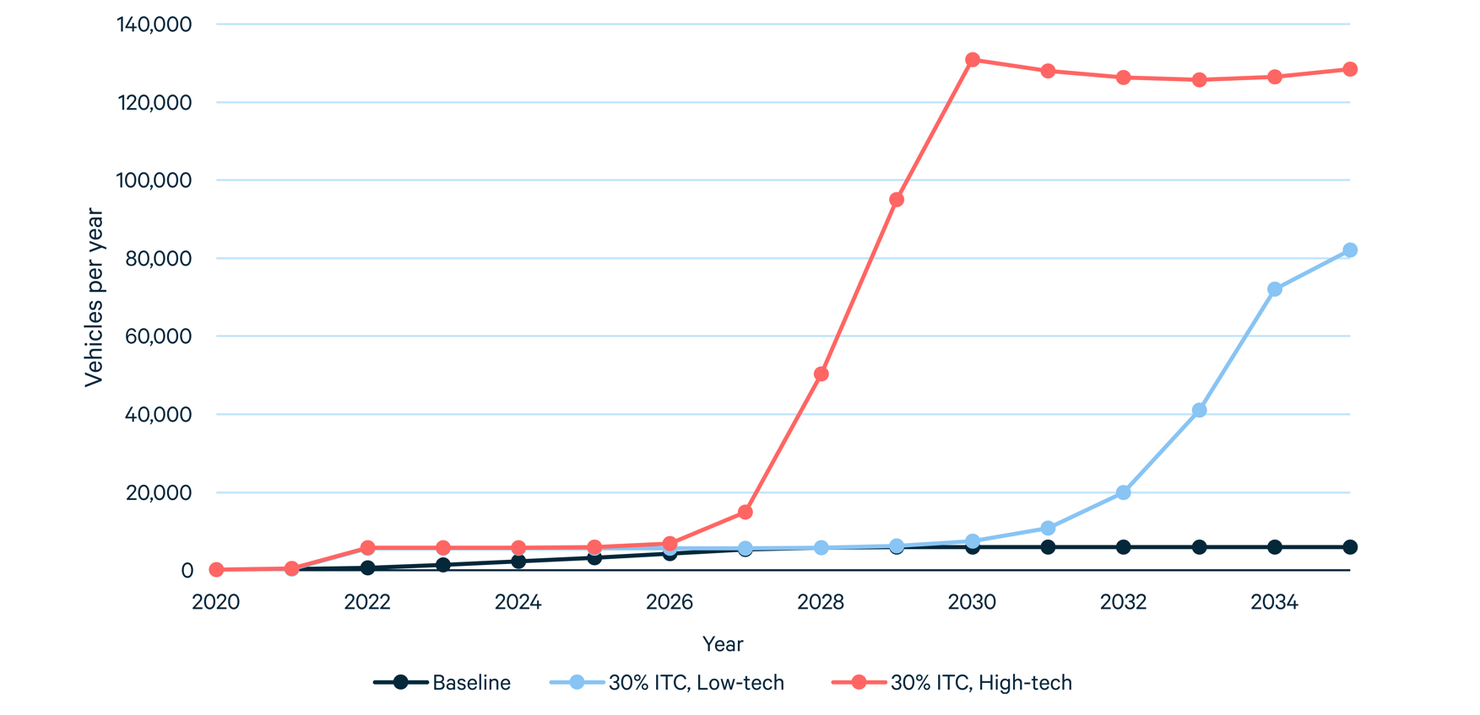

Figure 1 shows the effects of the subsidies on sales of electric transit buses, day cabs (which do not include a sleeping compartment for drivers), and sleeper cabs (which do). In the baseline scenario, sales of electric buses and trucks are close to zero through 2035. With the low-technology assumptions—which assume a relatively slow decline in the price of electric vehicles because of a slow reduction in battery costs—the 30 percent subsidy causes sales to increase noticeably around 2030, reaching about half of total sales by 2035. The high-technology scenario—which assumes a relatively rapid decline in the price of electric vehicles given a rapid reduction in battery costs—results in lower prices for electric vehicles; the lower prices cause electric vehicle sales to start increasing sooner and reach a higher level (about 80 percent of new sales in 2035) than in the low-technology case.

Figure 1. Total US Sales of Electric Transit Buses, Day Cabs, and Sleeper Cabs, Modeled under Different Subsidy Scenarios

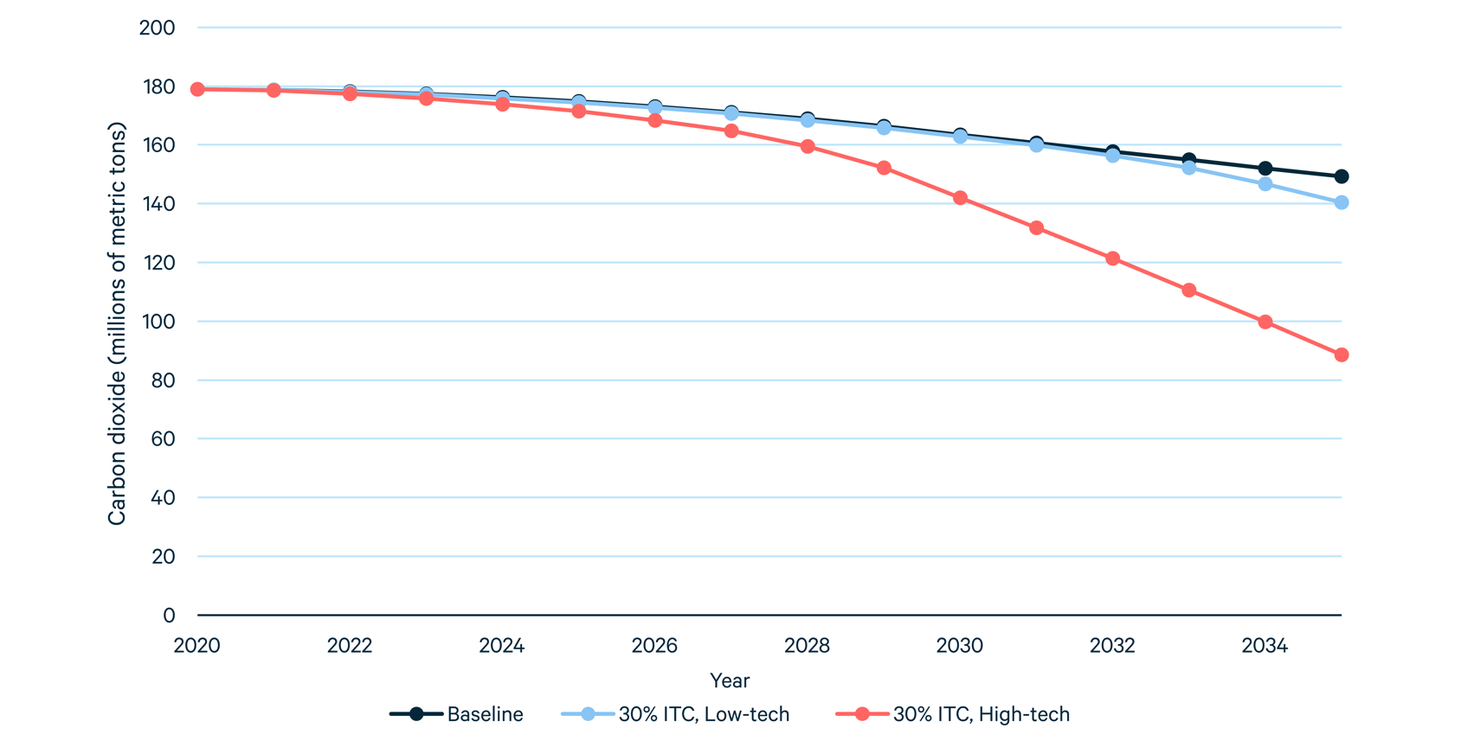

Subsidies reduce emissions by 6–40 percent in 2035 relative to the baseline case, depending on the assumptions about technology (Figure 2). Emissions reductions might seem slow at first, because of the lingering impacts of existing vehicles in the fleet, which are typically retired after more than a decade on the road; in a given year, only about 10 percent of buses and trucks on the road were purchased new that year. The subsidies for electric buses and trucks reduce carbon dioxide emissions from new vehicles, but climate damages depend on emissions from all on-road vehicles—not just the new ones. Therefore, the effects of subsidies on carbon dioxide emissions depend on the number of all on-road vehicles that are electric.

Figure 2. Carbon Dioxide Emissions Reductions Modeled under Different Subsidy and Technology Scenarios

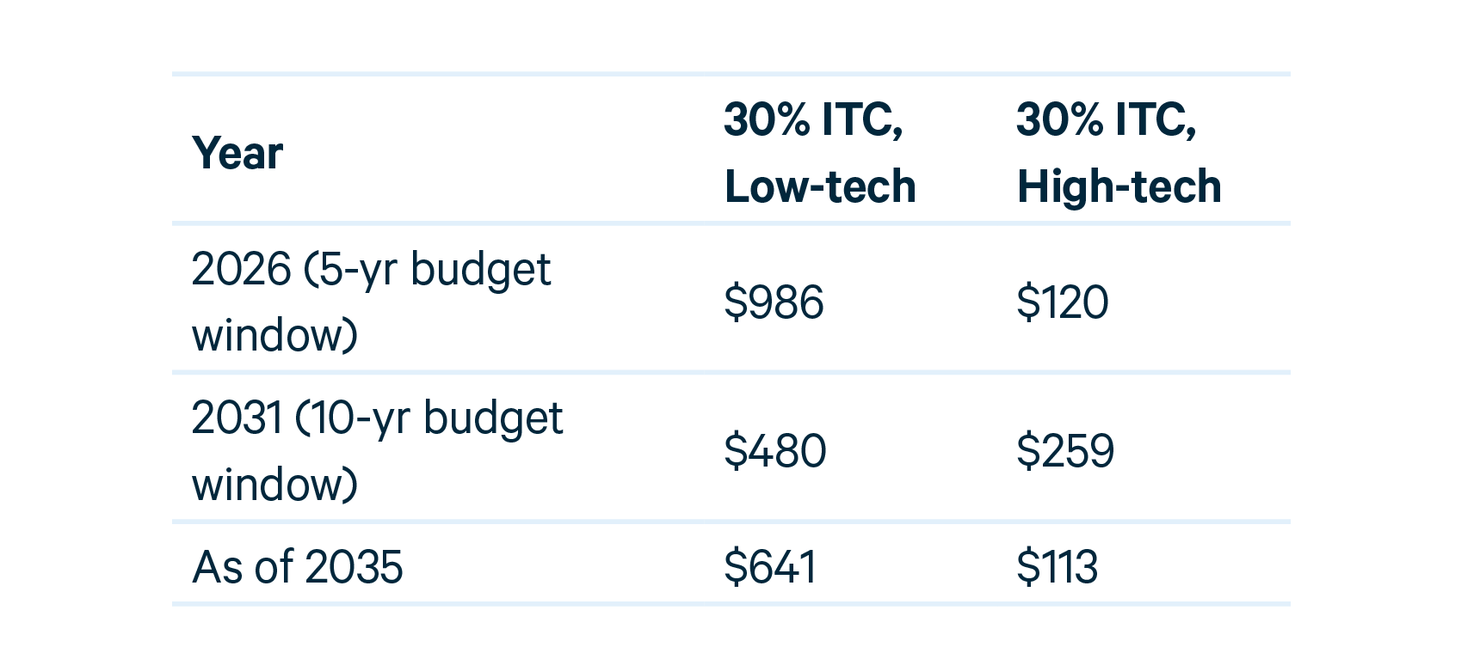

Table 1. Fiscal Cost-Effectiveness of Electric Vehicle Subsidies (US$ Per Ton of Carbon Dioxide Reduction)

We find that subsidies for electric buses and electric trucks can substantially affect new vehicle sales, the proportion of electric vehicles on the road, and associated carbon dioxide emissions; the timing of these effects depends on the pace of battery price reductions—and ultimately on the pre-subsidy total cost of ownership of electric MHDVs versus diesel MHDVs.

Battery price reductions have an important implication for technology policy. Our analysis suggests that combining subsidies with policies that spur innovation and accelerate battery cost reductions could achieve far greater emissions reductions than subsidies alone.

This post also appears on Resources for the Future’s Common Resources blog.