Dale Johnson, Farm Management Specialist

University of Maryland

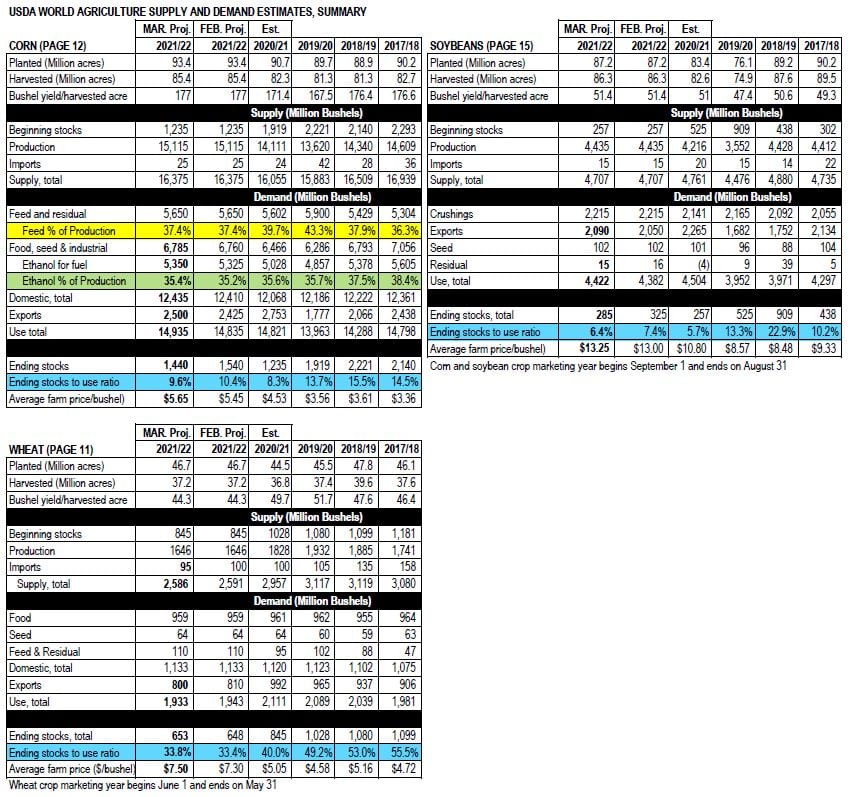

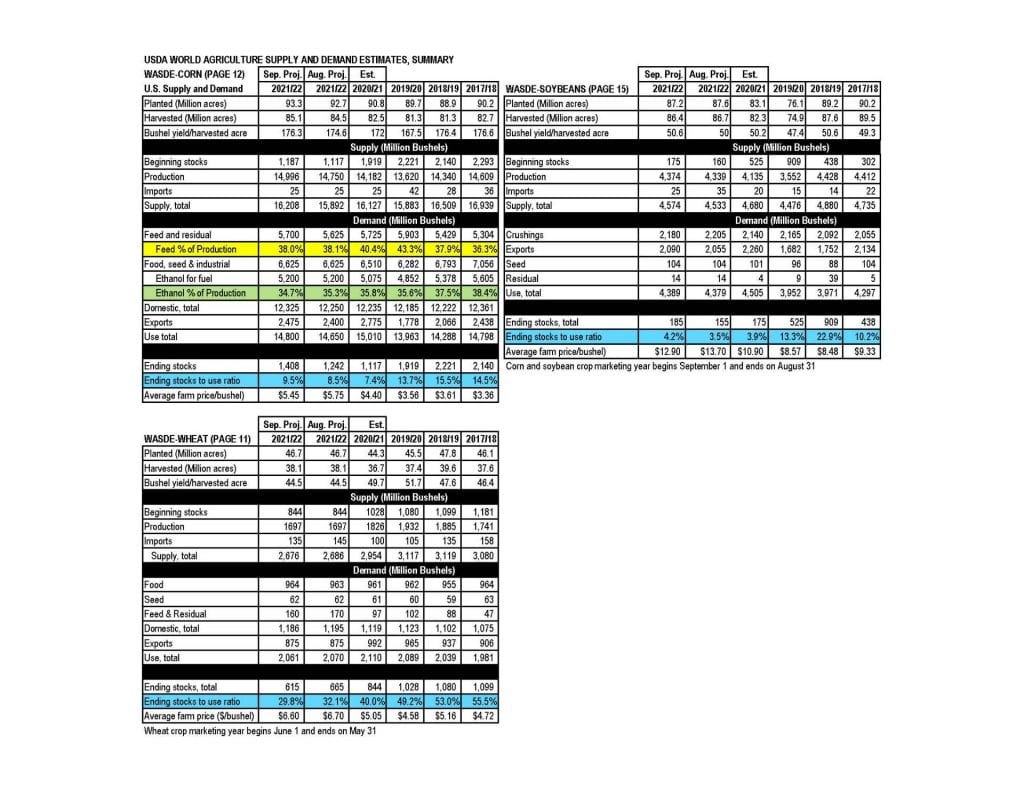

Information from USDA WASDE report

Attached is the summary for the April 2022 WASDE.

Corn

There were no changes on the corn supply side from the March 9 WASDE estimates. On the demand side, there were minor changes but total use and Ending stocks remained the same. Ending stocks are estimated to be 1,440 million bushel, with a stocks-to-use ratio of 9.6%. December 2022 Corn futures remain in a bullish volatile market with prices increasing from $6.37 on March 9 to a high of $7.18 on April 8 as extraordinary world events drive market prices up. A lower than expected prospective plantings report on March 31 pegged planting at 89.5 million contributed to higher prices for the 2022 crop year.

Soybean

There were no changes on the soybean supply side from the March 9 WASDE estimates. On the demand side, export estimates were increased by 25 million bushel, seed was increased by 4 million bushel and the residual estimate was decreased by 3 million bushel. This resulted in a lower estimate of ending stocks at 260 million bushel and a decrease in the stocks-to-use ratio from 6.4% to 5.8%. November 2022 futures prices have been volatile the past month. A higher than expected prospective plantings report on March 31 pegged planting at 91 million contributed to a price dip but has since recovered to a high of $14.98 on April 8.

Wheat

On the supply side, import estimates were decreased by 5 million bushel. On the demand side, Feed & Residual was decreased 10 million bushel. Export estimate was decrease by 25 million bushel. These changes increased the ending stocks by 30 million bushel to 678 million bushel and the stocks to use ratio increased from 33.4% to 35.5%. On March 3 & 7, the market was limit up as trading was halted on those days. The market then went limit down on March 8, 9 , & 10. On March 9 &10 there was no trading. The market has declined since then from the $12.50 range to a high of $10.60 on April 8.