Andrew Kness, Senior Agriculture Agent | akness@umd.edu

University of Maryland Extension, Harford County

Tar spot is on the mind of many farmers as we enter the 2024 growing season and I have had many conversations with farmers and consultants about strategies for managing this disease. Here are some things to consider and keep in mind as we get into the peak of the corn growing season.

Tar spot is a disease of corn caused by the fungus Phyllachora maydis. This disease was first reported in limited amounts in Harford and Cecil County in 2022; in 2023 the disease spread to at least 8 counties in Maryland and by harvest ‘23, we found tar spot at a frequency of over 50% of fields scouted here in Harford County.

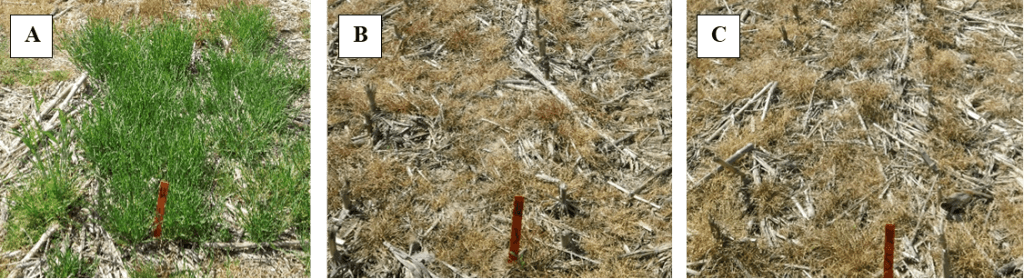

The tar spot disease cycle starts with old corn crop residue where the fungal spores lay dormant over winter. As conditions become optimal for its development in late spring/summer, spores are released and blown and/or splashed onto corn plants where the spore will germinate and infect the plant. Approximately 12-15 days after infection, symptoms will develop on the corn leaves and/or husks, which include dark, raised, lesions, which are the reproductive structures called stromata (Fig. 1). Inside the stromata are spores (Fig. 2), which are released and will infect new tissue. Tar spot is a polycyclic disease, meaning it has multiple generations or cycles per year. New infections will occur throughout the growing season for as long as green, living corn tissue is present and environmental conditions are favorable.

Here in Maryland and the Mid-Atlantic, tar spot has not been reported to cause any significant epidemics or yield losses thus far, mostly because it becomes established late in the growing season; but that is not to say that serious epidemics couldn’t happen. In the Midwest, tar spot has been reported to cause upwards of 50 bushel per acre yield loss, and it was ranked the #1 yield-limiting disease for corn in the U.S. in 2021, 2022, and 2023.

Since tar spot was first confirmed in the United States in 2015, we have learned a lot about its epidemiology. Tar spot hails from the cooler mountain areas of Latin America. When tar spot first moved into the U.S., we had initially thought that mild temperatures and moisture were key variables in the development of the disease; however, recent research has found that moisture plays a role, but temperature is far more crucial. Webster et. al. (2023) found that monthly temperature average between 64-73°F were optimal for tar spot development and temperatures exceeding 73°F significantly reduced tar spot progression. What was more interesting is that they found that moisture both promoted and inhibited tar spot disease progression. Moisture early in the disease cycle aids in infection, but prolonged moisture (greater than 90% humidity) actually inhibits disease progression. Tar spot develops when relative humidity is less than 90% for a 2-3 week period, coupled with mild temperatures. This makes sense for many that may have observed tar spot in 2023, which was not a particularly wet year.

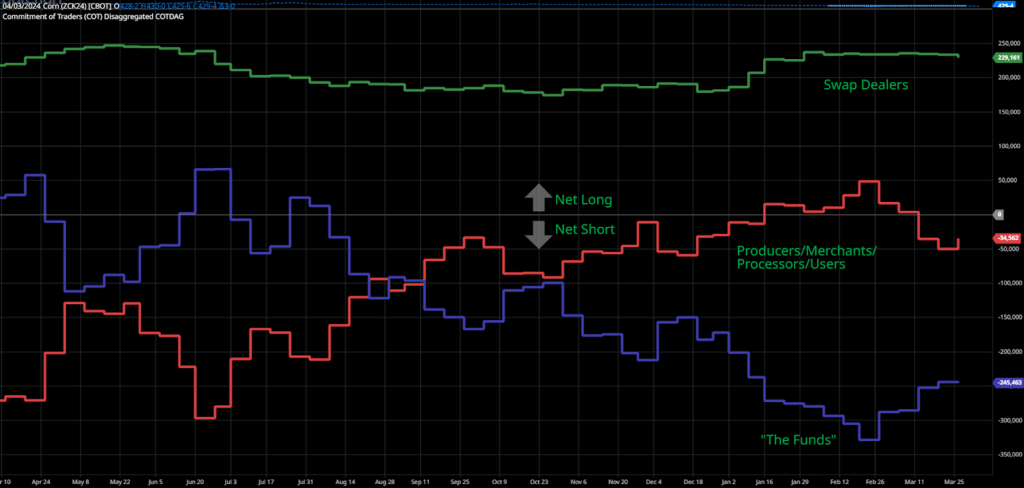

With this in mind, we should consider how these weather parameters influence our management of this disease here in Maryland where our summers tend to be hotter and more humid than many areas of the corn belt states.

If you look at the 5-year average monthly temperatures from regional weather stations (Table 1), you can see that the months of July and August for Mid-Atlantic regions are well outside of the 64-73°F window for optimum tar spot development. Compare that with data from Iowa for example, and they consistently run within or very close to the optimal temperature range. While only a few degrees may not seem like much, I believe our hot summers may actually keep tar spot at bay until later in August and September on an average year, which would be consistent with when we have found tar spot in Maryland in 2022 and ‘23. If these trends hold true, the majority of our corn crop is well into later grain fill stages by the time milder temperatures arrive, effectively avoiding tar spot development during the most crucial growth stages. In contrast, 30-day average temperatures are within or near the 64-73°F optimum range during corn’s most vulnerable growth stages in the corn belt.

| Table 1. Average Monthly Temperatures (°F), 2019-2023 | ||||

| Westminster, MD | Salisbury, MD | Arlington, VA | Waterloo, IA | |

| May | 63.46 | 64.08 | 66.13 | 60.70 |

| June | 72.48 | 72.95 | 75.53 | 72.90 |

| July | 79.54 | 77.99 | 80.96 | 75.52 |

| August | 77.22 | 76.25 | 78.77 | 72.00 |

| September | 69.94 | 69.99 | 72.60 | 66.20 |

Where tar spot could become problematic here are instances where we have an unusually cool June and July which would put the majority of our corn at risk of tar spot infection during it’s most vulnerable time, which is tasseling through early to mid grain full.

Another situation where tar spot could be a problem is for late planted and late maturing hybrids that are in reproductive phases in August and September. Fields that are corn after corn are also in a higher risk situation.

For 2024, I would highly recommend scouting and paying close attention to the weather conditions just prior to tasseling through grain fill in your corn fields. There is an app that can help you determine your tar spot risk, called Tarspotter, and has been reported to be 90% accurate. The app takes into consideration regional weather data and field management to determine a risk percentage. It’s available for download for free on iPhone and Android.

If you decide to treat your corn with a fungicide to manage tar spot, VT/R1 timing is still found to be the most effective and economical. A fungicide application at this time will also effectively manage other common foliar fungal diseases of corn (which we shouldn’t forget about), such as grey leaf spot and northern corn leaf blight. Most fungicides labeled for tar spot are effective, however there is a better response to products that have 2 and 3-way modes of action.

This year we will continue to conduct research on tar spot in Maryland with funds from the Maryland Grain Producers Utilization Board. If you find tar spot this year, please report your findings to me via email (akness@umd.edu) or phone (410-638-3255) or on corn.ipmpipe.org.