Dale Johnson, Farm Management Specialist

University of Maryland

Information from USDA WASDE report

Attached is the summary for the April 2023 WASDE.

Corn

This month’s ‘22/23 U.S. corn outlook is for reductions to imports and food, seed, and industrial (FSI) use, with unchanged ending stocks. Corn imports are lowered 10 million bushels based on observed trade to date. Feed and residual use is unchanged at 5.275 billion based on indicated disappearance during the December-February quarter. FSI is lowered 10 million bushels reflecting cuts to corn used for glucose and dextrose and starch. With supply and use falling by the same amount, ending stocks are unchanged at 1.342 billion bu. The season-average price is unchanged at $6.60 per bu.

Soybeans

U.S. soybean supply and use forecasts for ‘22/23 are unchanged relative to last month. Soybean and soybean meal prices are also unchanged. The soybean oil price is projected at 64.0 cents per pound, down 2 cents. Global ‘22/23 soybean supply and demand forecasts include lower production, crush, and exports. Global soybean production is reduced 5.5 million tons to 369.6 million. Lower crops for Argentina and Uruguay are partly offset by higher production for Brazil. Soybean production for Argentina is lowered 6.0 million tons to 27.0 million on hot and dry weather conditions through March. Uruguay production is lowered 0.9 million tons to 1.2 million on a lower harvested area and yield. Partly offsetting is higher production for Brazil, increased 1.0 million tons to 154.0 million on higher area. Soybean crush is lowered on reduced supplies and slow pace to date for Argentina, China, Bangladesh, Pakistan, and Egypt. Crush for Argentina is reduced 3.3 million tons to 32.0 million leading to lower product exports. Partly offsetting is higher crush and higher soybean oil and meal exports for Brazil. Soybean exports are lowered 0.4 million tons to 168.0 million on lower exports for Uruguay. Imports are lowered for Bangladesh, Egypt, and Pakistan and raised for Argentina. Soybean ending stocks are raised fractionally with higher stocks for China and Brazil that are mostly offset by lower stocks for Argentina.

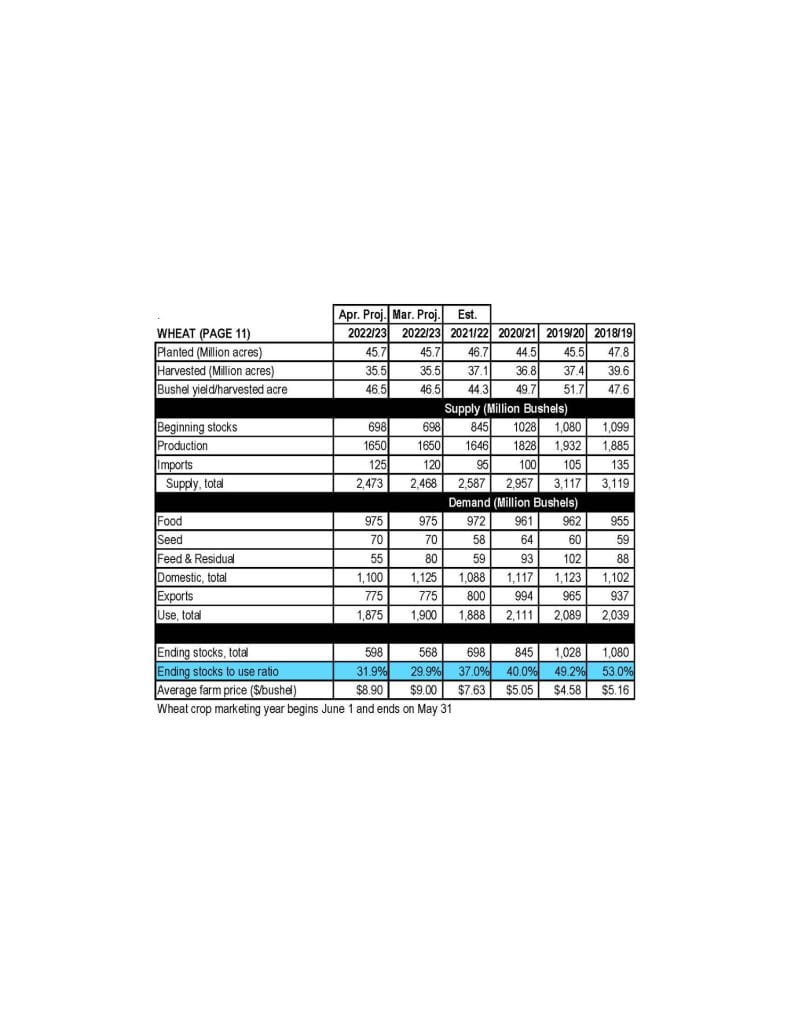

Wheat

The outlook for ‘22/23 U.S. wheat this month is for slightly higher supplies, reduced domestic use, unchanged exports, and increased ending stocks. Supplies are raised 5 million bushels on higher imports, based on the pace of Census imports reported to date. Domestic use is lowered 25 million bushels on reduced feed and residual use, which is decreased to 55 million. The downward revision is based on the implied disappearance for the second and third quarters indicated in the NASS Grain Stocks report. Wheat exports remain at 775 million bushels but there are offsetting by-class changes for White and Hard Red Spring exports. Projected ‘22/23 ending stocks are raised 30 million bushels to 598 million but are still 14% below last year. The ‘22/23 season-average farm price is forecast $0.10 per bushel lower at $8.90, based on NASS prices reported to date and expectations for cash prices for the remainder of ‘22/23. The global wheat outlook for ‘22/23 is for increased supplies, higher consumption, and reduced trade and stocks. Supplies are raised 0.7 million tons to 1,061.1 million, primarily on higher beginning stocks for Syria and increased production for Ethiopia. Global consumption is increased 2.9 million tons to 796.1 million, mainly on higher food, seed, and industrial use for India, and increased feed and residual use for China and the EU. World trade is lowered 1.2 million tons to 212.7 million on reduced exports by the EU, Argentina, and Brazil more than offsetting increases for Russia and Ukraine. China’s wheat imports are raised 2.0 million tons to 12.0 million, which would be the highest imports for China since 1995/96. China’s imports are raised on strong imports to date, particularly from Australia; China is now the leading 2022/23 global wheat importer. Projected 2022/23 world ending stocks are lowered 2.1 million tons to 265.1 million, the lowest since 2015/16. This month, India, the Philippines, and Ukraine are projected to have lower stocks, more than offsetting increases for Syria, the EU, and the United States.