Dale Johnson, Farm Management Specialist

University of Maryland

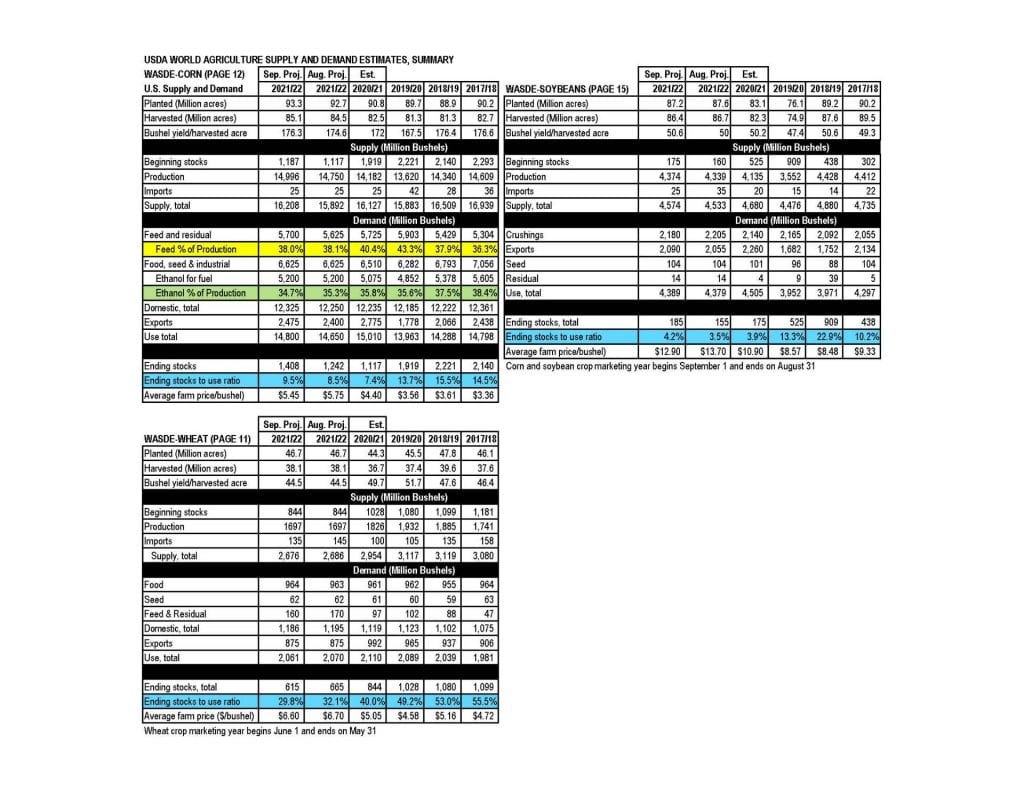

Information from USDA WASDE report

Attached is the summary for the February 2022 WASDE.

Corn

There were no changes in corn estimates from the January 12 WASDE report to the February 9 WASDE report. Ending stocks are estimated to be 1,540 million bushel with a stocks to use ratio of 10.4%. March 2022 Corn futures increased from $5.99 on January12 to peak at $6.45 on February 9 at the time of this report.

Soybeans

There were no changes in supply estimates. On the demand side, the estimate for crushings was increased by 215 million bushels. This resulted in a lower estimate of ending stocks at 325 million bushel and a decrease in the stocks-to-use ratio from 8.0% to 7.4%. March 2022 futures price increased dramatically from $13.99 on January 12 to peak at $15.97on February 9 at the time of this report- OH! so close to $16.00 beans!

Wheat

On the supply side, there were no changes in the estimates from January to February. On the demand side, Food estimate was decreased by 3 million bushel. Seed estimate was decreased by 2 million bushel. Export estimate was decreased by 15 million bushel. These changes increased the ending stocks by 20 million bushel to 648 million bushel and the stocks to use ratio increased from 32.0% to 33.4%. March futures increased from $7.58 on January 12 to peaked at 8.32 on January 25 but have since backed off to trade at a high of $7.88 pm February 9 at the time of this report.