Western Maryland

Erratic weather patterns continue to dominate and challenge us here in Washington County. While we can still use precipitation, it has recently been coupled with wild temperature swings. In the 70s or low 80s and then back to the low fifties with nighttime temperatures on several occasions hovering near freezing. Triticale harvest is over half finished but very little corn has gone in the ground. First cutting alfalfa will begin early next week barring rain showers. First cutting hay of any kind looks like it will be below normal. Forever the optimist, second cutting will be better.—Jeff Semler, Washington Co.

Central Maryland

Small grain silage harvest is in full swing. Manure is being hauled and corn is being planted. Some soybeans have been planted. First cutting of hay may also start soon. Over the past month, most of the area has been at or above normal rainfall, according to the National Weather Service. Field work may slow down depending on much rain we get this weekend, but next week is forecasted to be drier and in the 70s. —Kelly Nichols, Montgomery Co.

Northern Maryland

The trend for April has been a continuation of March—cool temperatures that rarely want to move out of the 60s. As a result, the start of planting was about a 5-10 days later than usual for this region. Most planting kicked off the week of Easter. In general, small grains look good. Barley is headed out and wheat is a couple of weeks away. Some rye has been chopped for feed. Pastures and hay fields are enjoying the cooler temperatures.—Andy Kness, Harford Co.

Upper & Mid Shore

Soil moisture has been perfect for spring crops, field work, and planting. Soil temperatures have been a little cool for this time of year. Many acres of corn and beans have went in over the past week. Barley is fully headed and wheat will be in a few days. Both look good. Hay and pastures look good, but the cool weather has them a little behind normal.—Jim Lewis, Caroline Co.

Lower Eastern Shore

Wheat is starting to pollinate. It’s been a relatively dry spring, making for an average to above average wheat crop, with minimal disease pressure. Cover crops have been mostly terminated. However, where still standing, cover crops are looking great. These late-terminated cover crops should bring additional benefits to the fields, such as providing substantial organic matter to the soil, and in some cases releasing nitrogen on the soil surface. Growers have spread poultry manure. Weather has been relatively favorable these last couple of weeks for planting. Corn has started to be planted. Much more corn acreage is expected to be planted in the next weeks, to be followed by soybean planting.—Sarah Hirsh, Somerset Co.

Southern Maryland

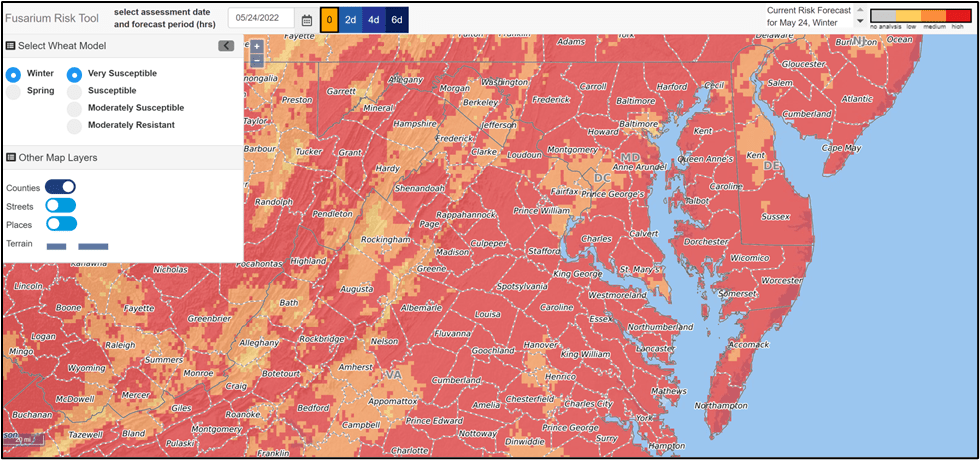

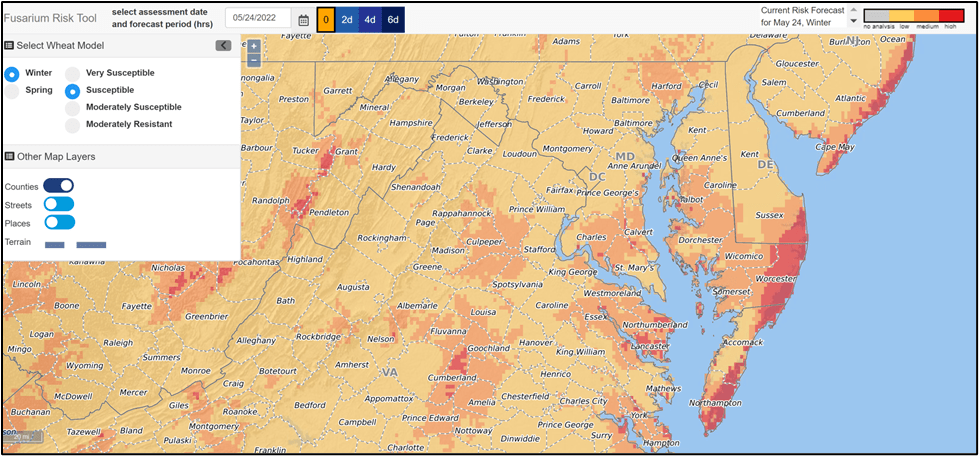

The region has experienced good planting conditions over the last week. Corn planting progress is still a bit behind schedule with cooler soils limiting the number of early-planted acres. Most farmers are finishing up with corn planting and have started with soybean planting. Recent showers were welcome with soil conditions becoming slightly dry during the last couple of weeks. Wheat is in the early heading stage and many fields will be flowering by the time you read this. Farmers will be evaluating the need for a head scab fungicide in the next few days. Many wheat fields are exhibiting yellowing in the upper canopy that is not readily attributable to any disease. We are also seeing a lot of powdery mildew in the lower canopy, but very little in the upper canopy. Insect and disease pressure has been light so far. Forage crops look great this spring. Alfalfa weevil are very active this year and many fields required treatment. Pyrethroid resistance continues to be an issue for our growers. First cutting of cool season grasses is underway.—Ben Beale, St. Mary’s Co.

*Regions (counties):

Western: Garrett, Allegany, Washington. Central: Frederick, Montgomery, Howard. Northern: Harford, Baltimore, Carroll. Upper & Mid Shore: Cecil, Kent, Caroline, Queen Anne, Talbot. Lower Shore: Dorchester, Somerset, Wicomico. Southern: St. Mary’s, Anne Arrundel, Charles, Calvert, Prince George’s