Note: This post is co-authored with Jeronimo Callejas and Jevgenijs Steinbuks, and it is published on the World Bank blog.

Passenger cars account for 45% of global greenhouse gas emissions from transport while greatly harming air quality in major cities. Transitioning from gasoline and diesel-powered to battery electric vehicles is a promising option to decarbonize passenger transport worldwide. Some countries have recently made impressive pledges to fully phase out sales of new gasoline and diesel vehicles over the coming decades—the growing list includes not only high-income countries like England and France but also some emerging economies such as China, India, Costa Rica, and Ghana.

Even more countries offer ample incentives for buying new electric vehicles, such as lower taxes, purchase subsidies, free parking, and high-occupancy vehicle lane privileges. These incentives have worked well in developed economies and China but not in other developing countries, at least judging by their low uptake. Some impediments to electric vehicle incentives in developing countries, such as lower consumer income or interest in electric vehicles, unreliable power supply, and scarce charging infrastructure, are well known. Other barriers, such as distortions caused by protective regulations, entry barriers, and market power, have received less attention from academics and policymakers alike.

To improve our understanding of this issue, a recent World Bank paper that we wrote—Welfare and Environmental Benefits of Electric Vehicle Tax Policies in Developing Countries: Evidence from Colombia—underscores the importance of market power distortions when designing tax policies to support hybrid and electric vehicles in middle-income countries. We chose Colombia, Latin America’s fourth-largest automobile sales and production market, as a case study. To reach the goals of the Paris Agreement, the Colombian government has set an ambitious goal of reducing greenhouse gas emissions by 20% by 2030.

We analyzed recently adopted policies in Colombia as well as a proposal for a carbon tax incentive. In 2017, Colombia substantially reduced sales taxes for all hybrid and electric vehicles and nearly eliminated import tariffs on these vehicles. After Colombia implemented these tax policies, we saw a major increase in electric vehicle sales. By 2020, the combined market share of plug-in electric and hybrid vehicles reached 5%, placing Colombia second after China among developing countries (Figure 1).

Figure 1. Market Share of Electric and Hybrid Vehicles in Colombia’s New Vehicle Market.

Note: Authors’ calculations based on IHS Markit new vehicle registration data. Data illustration: Giannina Raffo.

Using an economic model of the new vehicle market, we found that, although Colombia’s tax policies were effective at increasing sales, they came at high costs. We estimate the fiscal cost at $350-$510 per metric ton of carbon dioxide avoided and the average private welfare cost at $40-$48 per ton of carbon dioxide, where private welfare costs include lower consumer wellbeing and manufacturer profits.

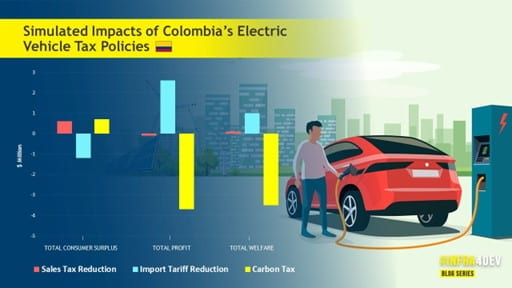

At first glance, it may be surprising that the tax policies reduce private welfare. After all, pre-existing sales taxes and import tariffs were distortionary because they reduced vehicle purchase levels below levels that consumers would have preferred in their absence. One would expect that lowering or eliminating such distortionary policies would make vehicle consumers and producers better off. Even more surprising is our finding that a carbon dioxide emissions rate tax (which is similar to a recently proposed policy in Colombia, and which imposes a purchase tax that is proportional to the vehicle’s rate of carbon dioxide emissions per kilometer of travel) has higher welfare costs than reducing sales taxes or import tariffs (Figure 2). Typically, we would expect an emissions rate tax to be more efficient than the other tax policies because only the emissions rate tax incentivizes consumers to substitute from higher to lower-emitting gasoline and diesel cars.

Figure 2. Simulated Impacts of Colombia’s Electric Vehicle Tax Policies.

Note. Authors’ estimates based on an economic model of the new vehicle market. The figure shows simulated changes in total consumers’ surplus, manufacturers’ profits, and private welfare compared to a hypothetical scenario when no tax policies are implemented. 2019 was chosen as a baseline reference year to avoid vehicle market distortions caused by the COVID-19 pandemics. Data illustration: Giannina Raffo.

Distortions caused by market power help explain both findings. Colombia’s automobile market can be described as an oligopoly, meaning that it is highly concentrated around a small number of players, with the top-five gasoline and diesel-powered models accounting for almost half of the country’s sales. According to our analysis, high-polluting vehicles have larger markups (i.e., the difference between their price and the marginal cost) than hybrid and plug-in electric vehicles. In other words, traditional gas or diesel-powered vehicles tend to generate larger profits for distributors and retailers. But the new tax policies cause sales of hybrid and plug-in vehicles to increase at the expense of higher-emitting vehicles. Because the latter are more profitable, the shift of sales from higher to lower-emitting cars reduces oligopolists’ profits. Even though consumers benefit from the lower taxes, it turns out that the drop in manufacturer profits outweighs the consumer gains, and overall, cutting taxes reduces private welfare. Thus, paradoxically, policies that cause consumers to shift from gasoline to hybrid and electric vehicles may decrease private welfare.

These findings have important implications for getting electric vehicle tax policies right when new vehicle markets have sizeable market power distortions. Policymakers often care more about the consumer gains than the producer losses, especially when, like in Colombia, most cars are imported and sold under foreign-owned brands. This could make sales tax reduction their preferred policy option. On the other hand, the anticipated profit losses could also impact domestic employers (such as car dealerships) and dampen political support for the ‘textbook’ carbon tax policy—which would strengthen the case for other mechanisms like the import tariff reduction.

Most importantly, policymakers should coordinate sectoral policies to ensure that vehicle tax incentives come together with measures to reduce market distortions.