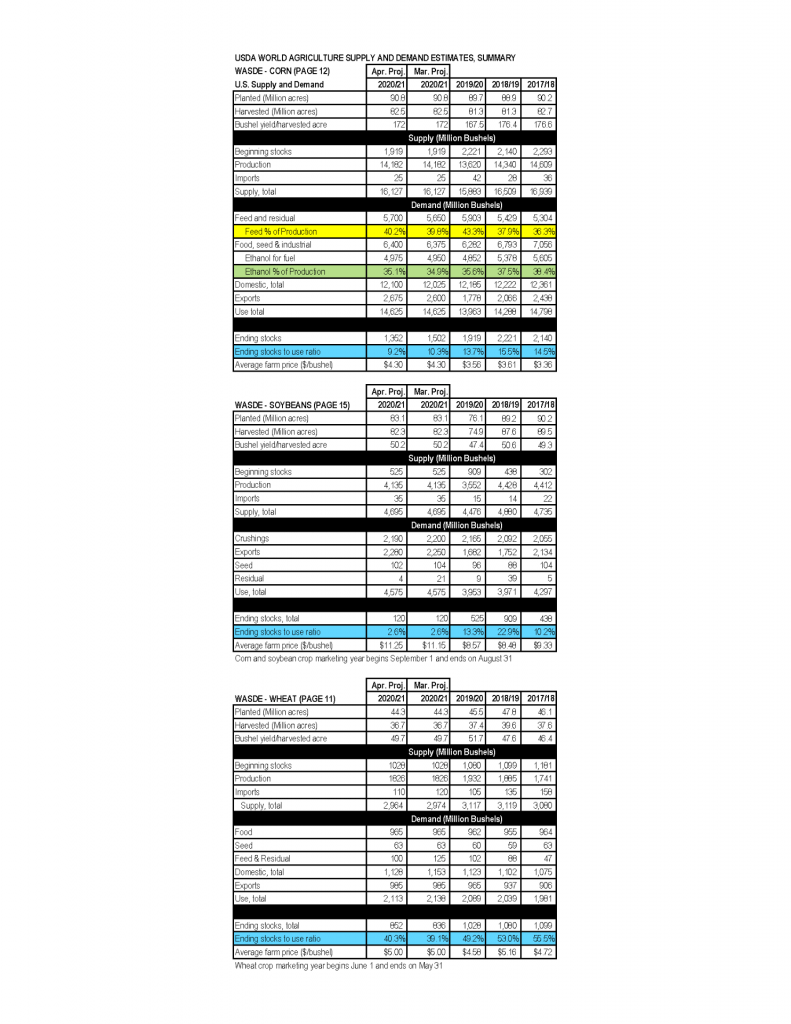

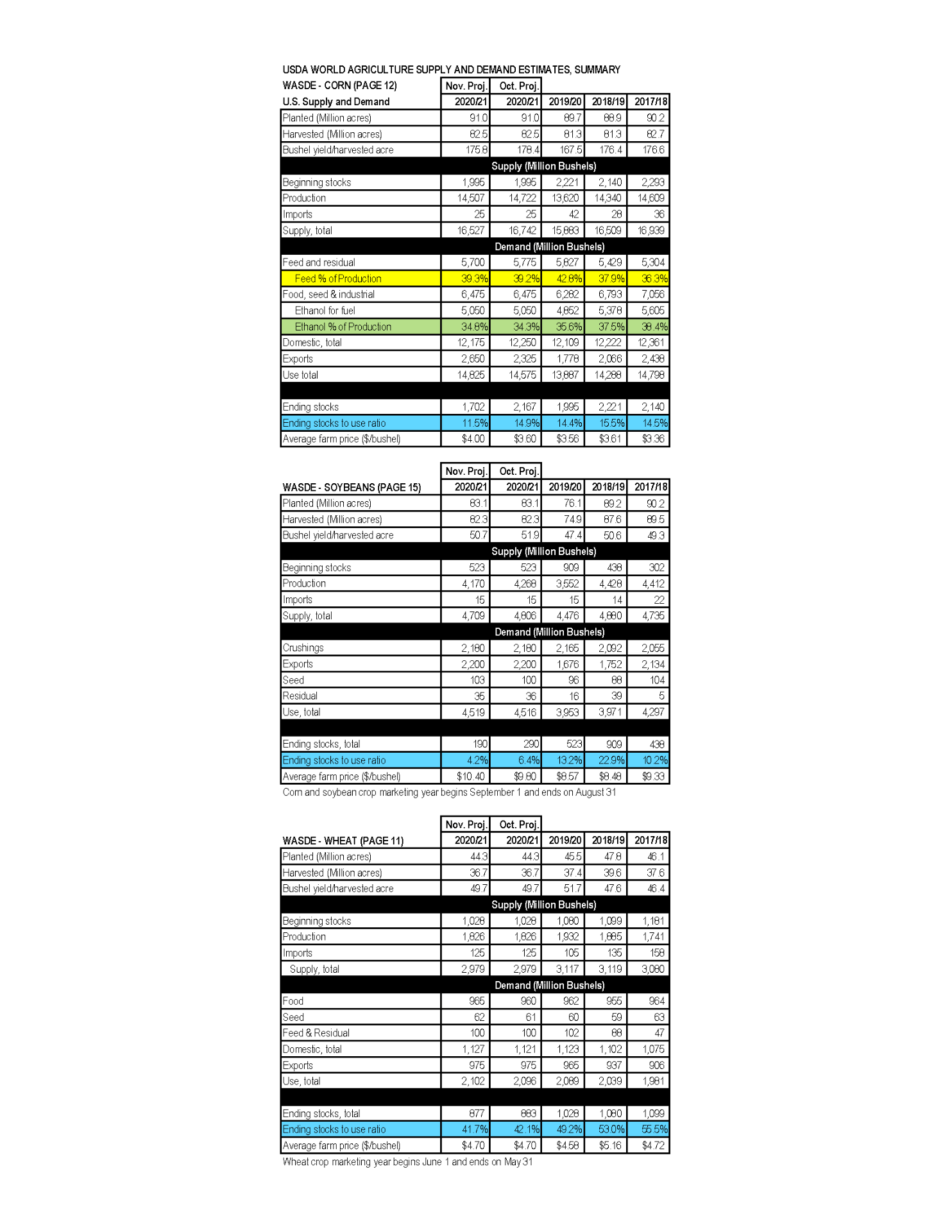

Information from USDA WASDE report

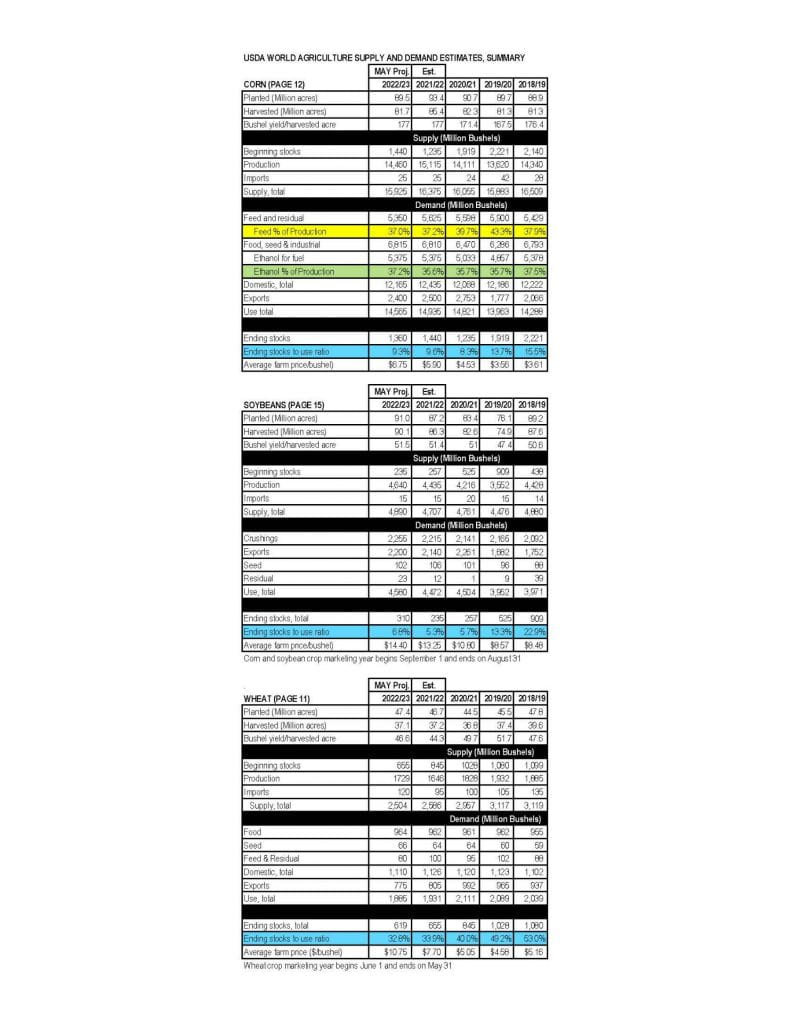

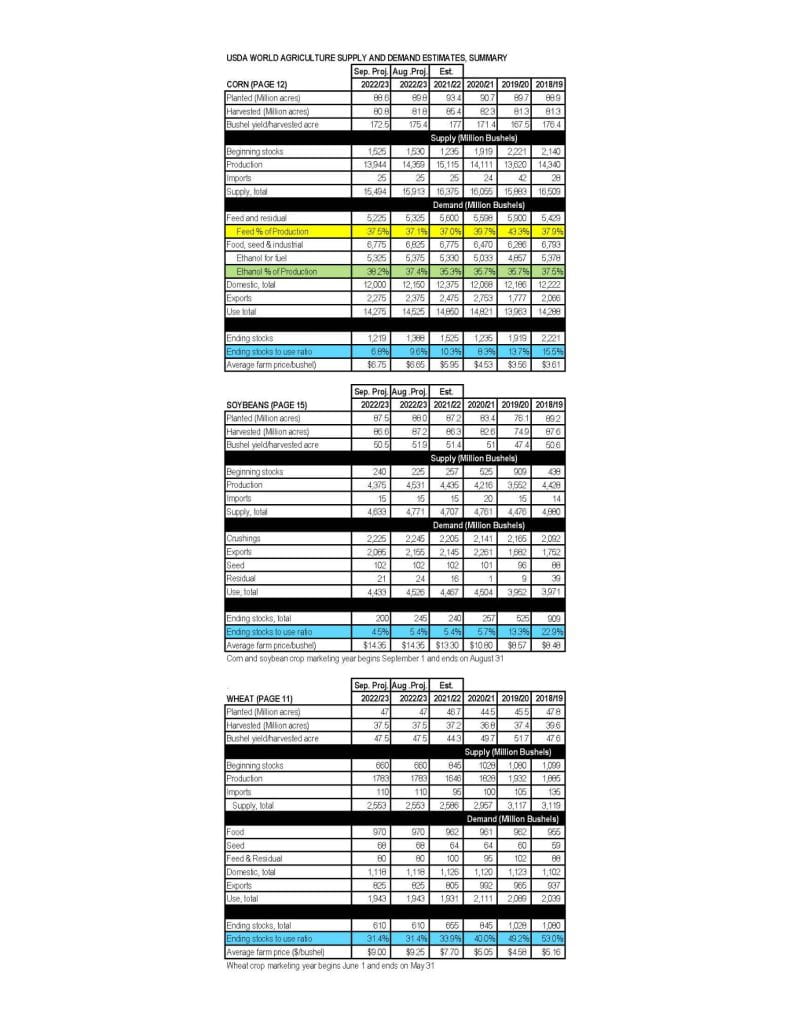

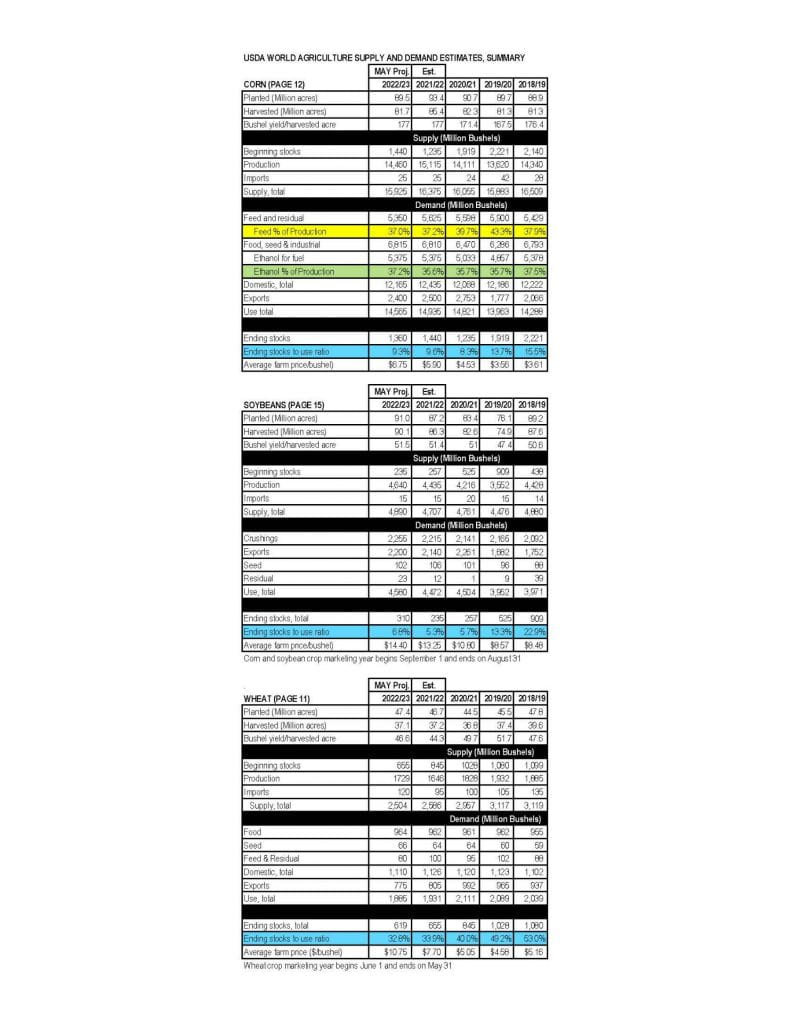

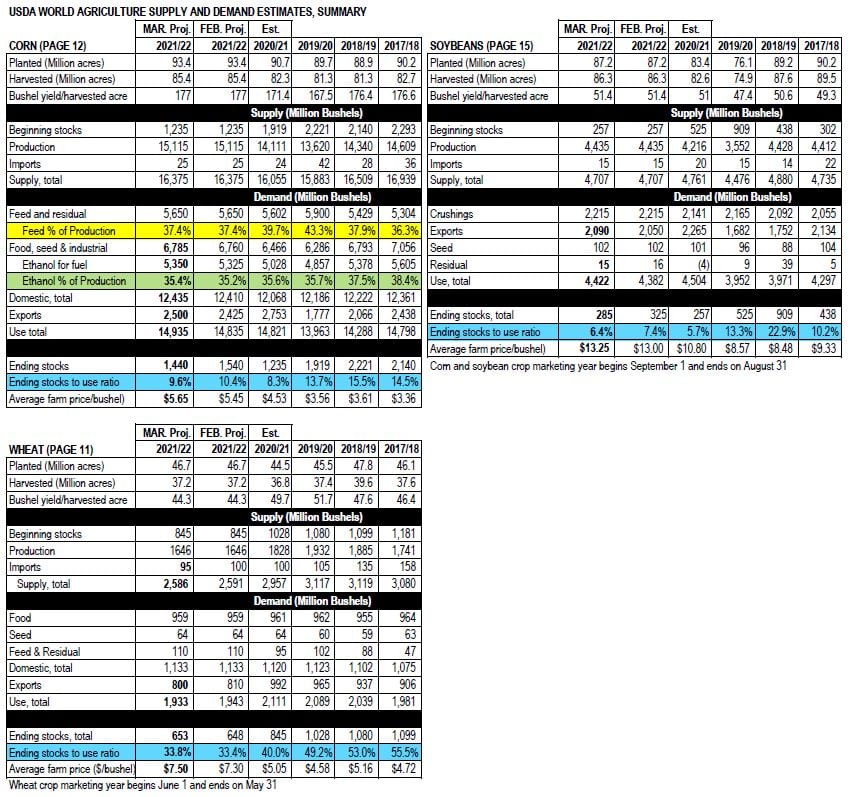

Attached is the summary for the May 2022 WASDE.

Corn

The 2022/23 U.S. corn outlook is for lower production, domestic use, exports, ending stocks, and higher prices. The corn crop is projected at 14.5 billion bushels, down 4.3 percent from last year. The corn yield is projected at 177.0 bushels per acre, 4.0 bushels below the weather adjusted trend presented at USDA’s Agricultural Outlook Forum in February. The very slow start to this year’s planting in the major corn producing States and the likelihood that progress by mid-May will remain well behind normal reduce yield prospects. Despite beginning stocks that are up relative to a year ago, total corn supplies are forecast to decline 2.7 percent to 15.9 billion bushels. Total U.S. corn use in 2022/23 is forecast to fall 2.5 percent on declines in domestic use and exports. Food, seed, and industrial (FSI) use is virtually unchanged at 6.8 billion bushels. Corn used for ethanol is unchanged relative to a year ago on expectations of flat U.S. motor gasoline consumption. Corn feed and residual use is down 4.9 percent relative to a year ago, reflecting a smaller crop, higher expected season-average farm prices received by producers, and a decline in grain consuming animal units. U.S. corn exports are forecast to decline 4.0 percent in 2022/23 as lower supplies and robust domestic demand limit prospects. Even with record exports projected for Argentina and Brazil, a 550-million-bushel drop in exports for Ukraine due to the ongoing conflict is the primary catalyst for a decline in world trade. With expectations of robust global demand in the face of high prices, the U.S. share of global corn trade is up slightly relative to a year ago. With total U.S. corn supply falling more than use, 2022/23 U.S. ending stocks are down 80 million bushels from last year. Stocks relative to use at 9.3 percent would be below a year ago and lower than the 14.4 percent average seen during 2015/16 to 2019/20. The season-average corn price received by producers is projected at $6.75 per bushel, up 85 cents from a year ago and if realized the highest since $6.89 reached during 2012/13.

Soybeans

The 2022/23 outlook for U.S. soybeans is for higher supplies, crush, exports, and ending stocks compared with 2021/22. The soybean crop is projected at 4.64 billion bushels, up 5 percent from last year’s crop mainly on higher harvested area. With slightly lower beginning stocks, soybean supplies are projected at 4.89 billion bushels, up 4 percent from 2021/22. The U.S. soybean crush for 2022/23 is projected at 2.26 billion bushels, up 40 million from the 2021/22 forecast. Domestic soybean meal disappearance is forecast to increase 2 percent from 2021/22 with low soybean meal prices relative to corn. U.S. soybean meal exports are forecast at 14.4 million short tons, leaving the U.S share of global trade near the prior 5-year average. With increased supplies, U.S. soybean exports are forecast at 2.2 billion bushels, up 60 million from the revised 2021/22 projection. Despite reduced soybean supplies available for export from South America for the first half of the 2022/23 marketing year, an anticipated record harvest and sharply higher exports beginning in early 2023 is expected to leave the U.S. with a lower share of global trade in 2022/23. U.S. ending stocks for 2022/23 are projected at 310 million bushels, up 75 million from the revised 2021/22 forecast. The 2022/23 U.S. season-average soybean price is forecast at $14.40 per bushel compared with $13.25 per bushel in 2021/22. Soybean meal prices are forecast down $20 per short ton from 2021/22 to $400 per short ton and soybean oil prices are forecast down 5 cents to average 70 cents per pound, as oilseed and product supplies rebound in foreign markets.

Wheat

The outlook for 2022/23 U.S. wheat is for reduced supplies, exports, domestic use stocks, and higher prices. U.S. 2022/23 wheat supplies are projected down 3 percent, as lower beginning stocks more than offset a larger harvest. All wheat production for 2022/23 is projected at 1,729 million bushels, up 83 million from last year, as higher yields more than offset a slight decrease in harvested area. The all wheat yield, projected at 46.6 bushels per acre, is up 2.3 bushels from last year. The first survey-based forecast for 2022/23 winter wheat production is down 8 percent from last year as lower Hard Red Winter and Soft Red Winter production more than offset an increase in White Wheat production. Abandonment for Winter Wheat is the highest since 2002 with the highest levels in Texas and Oklahoma. Spring Wheat production for 2022/23 is projected to rebound significantly from last year’s drought-reduced Hard Red Spring and Durum crops primarily on return-to-trend yields. Total 2022/23 domestic use is projected down 1 percent on lower feed and residual use more than offsetting higher food use. Exports are projected at 775 million bushels, down from revised 2021/22 exports and would be the lowest since 1971/72. Projected 2022/23 ending stocks are 6 percent lower than last year at 619 million bushels, the lowest level in nine years. The projected 2022/23 season-average farm price (SAFP) is a record $10.75 per bushel, up $3.05 from last year’s revised SAFP. Wheat cash and futures prices are expected to remain sharply elevated through the first part of the marketing year when the largest proportion of U.S. wheat is marketed.